The Safety Razor Company has a large tax-loss carry forward and does not expect to pay taxes

Question:

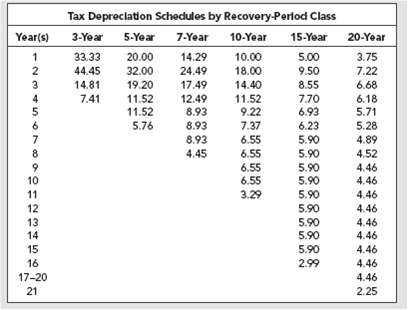

The Safety Razor Company has a large tax-loss carry forward and does not expect to pay taxes for another 10 years. The company is therefore proposing to lease $100,000 of new machinery. The lease terms consist of eight equal lease payments prepaid annually. The lessor can write the machinery off over seven years using the tax depreciation schedules given in Table 6.4. There is no salvage value at the end of the machinery's economic life. The tax rate is 35 percent, and the rate of interest is 10 percent. Wilbur Occam, the president of Safety Razor, wants to know the maximum lease payment that his company should be willing to make and the minimum payment that the lessor is likely to accept. Can you help him? How would your answer differ if the lessor was obliged to use straight-line depreciation?

Salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important...

Step by Step Answer:

Principles of Corporate Finance

ISBN: 978-0072869460

7th edition

Authors: Richard A. Brealey, Stewart C. Myers