Two alternatives are being considered: Base your computations on a MARR of 7% and an 8-year analysis

Question:

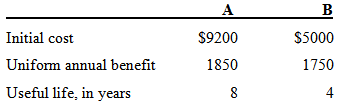

Two alternatives are being considered:

Base your computations on a MARR of 7% and an 8-year analysis period. If identical replacement is assumed, which alternative should be selected?

MARRMinimum Acceptable Rate of Return (MARR), or hurdle rate is the minimum rate of return on a project a manager or company is willing to accept before starting a project, given its risk and the opportunity cost of forgoing other...

Transcribed Image Text:

Initial cost $9200 $5000 Uniform annual benefit Useful life, in years 1850 1750

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 56% (16 reviews)

Year A B A B 0 9200 5000 4200 1 1850 1750 100 2 1850 1750 100 3 1850 1750 ...View the full answer

Answered By

Somshukla Chakraborty

I have a teaching experience of more than 4 years by now in diverse subjects like History,Geography,Political Science,Sociology,Business Enterprise,Economics,Environmental Management etc.I teach students from classes 9-12 and undergraduate students.I boards I handle are IB,IGCSE, state boards,ICSE, CBSE.I am passionate about teaching.Full satisfaction of the students is my main goal.

I have completed my graduation and master's in history from Jadavpur University Kolkata,India in 2012 and I have completed my B.Ed from the same University in 2013. I have taught in a reputed school of Kolkata (subjects-History,Geography,Civics,Political Science) from 2014-2016.I worked as a guest lecturer of history in a college of Kolkata for 2 years teaching students of 1st ,2nd and 3rd year. I taught Ancient and Modern Indian history there.I have taught in another school in Mohali,Punjab teaching students from classes 9-12.Presently I am working as an online tutor with concept tutors,Bangalore,India(Carve Niche Pvt.Ltd.) for the last 1year and also have been appointed as an online history tutor by Course Hero(California,U.S) and Vidyalai.com(Chennai,India).

4.00+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Economics questions

-

Two mutually exclusive alternatives are being considered for the environmental protection equipment at a petroleum refinery. One of these alternatives must be selected. The estimated cash flows for...

-

Two alternatives are being considered: If the minimum attractive rate of return is 7%, which alternative should be selected? A B $5000 First cost $9200 Uniform annual benefit Useful life, in years...

-

Two alternatives are being considered: Both alternatives provide an identical benefit. (a) Compute the payback period if Alt. B is purchased rather than Alt. A (b) Use a MARR of 12% and benefit-cost...

-

. The electric polarization P of a light wave for high values of the electric field E is given by: P= a(c,E+cE + cE) where a, c1, c2 and c3 are constants. Find the expression for the instantaneous...

-

A rectangular package to be sent by a delivery service (see figure) has a combined length and girth (perimeter of a cross section) of 120 inches. a) Use the diagram to write the volume V of the...

-

During her second year at the Juilliard School of Music in New York City, Ann Rylands had a chance to borrow for one month a rare Guadagnini violin made in 1768. She returned the violin to the owner...

-

Figure 2.3 displays the frequency distribution from Example 2.5. Create a similar plot using ggplot () to display the relative frequency distribution for each treatment group instead of the frequency...

-

Stilton Audio is a producer of speakers and amplifiers which are housed in plastic cabinets. Currently production of the plastic cabinets as well as final product assembly is completed in-house. For...

-

List the major traditional banks in Canada? 2. What other options for Canadian banking are there besides the "Big 5 "? 3. What is your preferred Canadian banking option? Name of institution: Bank of...

-

Banner Company produces three products: A, B, and C. The selling price, variable costs, and contribution margin for one unit of each product follow: Due to a strike in the plant of one of its...

-

Jean has decided it is time to purchase a new battery for her car. Her choices are: Jean believes the batteries can be expected to last only for the guarantee period. She does not want to invest...

-

Two investment opportunities are as follows: At the end of 10 years, Alt. B is not replaced. 'Thus, the comparison is 15 years of A versus 10 years of B. If the MARR is 10%, which alternative should...

-

The trial balance of Building Blocks Child Care does not balance. The following errors are detected: a. Cash is understated by $ 4,000. b. A $ 2,000 debit to Accounts c. A $ 1,200 purchase of office...

-

Suppose you are a cattle producer who is attempting to increase the weight of your cattle by 300 pounds to bring them up to market weight. Since you have already negotiated a fixed price for these...

-

1 (a) Computation of profit or loss on the disposal of Delta Disposal proceeds Net assets at date of disposal (W1) Unimpaired goodwill at date of disposal (W2) Non-controlling interest at date of...

-

Assuming that PayNet acquires 70% of Shale on August 1, 2022, for cash of $196,000, what amount would appear in the non-controlling interest (NCI) account on the consolidated balance sheet on the...

-

Evaluate the definite integral (if you input a number, please enter at least 4 digits): 2 1 dz - [ dx =

-

What are minimum acceptable discharge criteria, hose stream allowances, and water supply durations for the protection of the following facility using either CMDA sprinklers or K11.2 upright CMSA...

-

A positively charged nonconducting infinite sheet that has a uniform surface charge density \(\sigma\) lies in an \(x y\) plane. As shown in Figure P24.102, a circular region of radius \(R\) has been...

-

For a Poisson process of rate , the Bernoulli arrival approximation assumes that in any very small interval of length , there is either 0 arrivals with probability 1- or 1 arrival with probability ....

-

Find f. f'"(t) = t t

-

The Land Development Corporation is considering purchasing a bulldozer. The bulldozer will cost $100,000 and will have an estimated salvage value of $30,000 at the end of six years. The asset will...

-

For prices that are increasing at an annual rate of 5% the first year and 8% the second year, determine the average inflation rate () over the two years.

-

Because of general price inflation in our economy, the purchasing power of the dollar shrinks with the passage of time. If the average general inflation rate is expected to be 8% per year for the...

-

O O A Dundas Company's inventory records for its retail division show the following at May 31: (Click the icon to view the accounting records.) At May 31, 10 of these units are on hand. Dundas...

-

4. R got 35% hike in his salary and 20% incentive on sales. If R sold goods worth Rs. 850 last year and the salary was Rs 70, then how much more does he earn this year with sales of Rs.900?

-

Teachers salaries have not been increasing as fast as the pay in many other types of work. Explain why you think this might be true. use graph of the supply and demand for teacher's labor to help...

Study smarter with the SolutionInn App