Zehms Company began operations in 2010 and adopted weighted-average pricing for inventory. In 2012, in accordance with

Question:

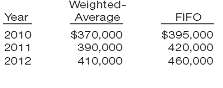

Zehms Company began operations in 2010 and adopted weighted-average pricing for inventory. In 2012, in accordance with other companies in its industry, Zehms changed its inventory pricing to FIFO. The pretax income data is reported below.

Instructions(a) What is Zehms's net income in 2012? Assume a 35% tax rate in all years.(b) Compute the cumulative effect of the change in accounting principle from weighted-average to FIFO inventory pricing.(c) Show comparative income statements for Zehms Company, beginning with income before income tax, as presented on the 2012 incomestatement.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: