The LMN Company maintains three bank accounts: City Bank-Regular, City Bank-Payroll, and Metro Bank-Special. Your analysis of

Question:

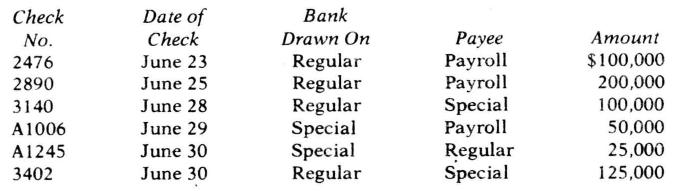

The LMN Company maintains three bank accounts: City Bank-Regular, City Bank-Payroll, and Metro Bank-Special. Your analysis of cash disbursements records for the period June 23 to July 6 reveals the bank transfers:

You determine the following facts about each of the first five checks: (1) the date of the cash disbursements journal entry is the same as the date of the check, (2) the payee receives the check two days later, (3) the payee records and deposits the check on the day it is received, and (4) it takes five days for a deposited check to clear banking channels and be paid by the bank on which it is drawn. Check 3402 was not recorded as a disbursement until July 1 . This check was picked up by the payee on the date it was issued and it was included in the payees after-hours bank deposit on June 30.

Required:

a. What are the purposes of the audit of bank transfers?

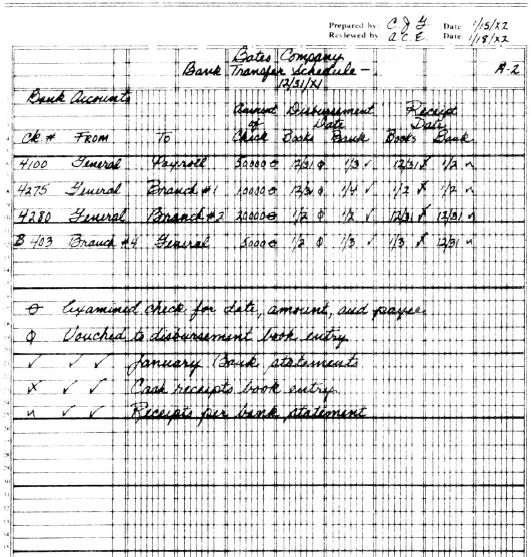

b. Prepare a bank transfer schedule as of June 30 using the working paper format illustrated in Figure 12-4.

c. Prepare separate adjusting entries for any checks that require adjustment

d. In the reconciliations for the three bank accounts, indicate the check rumbers that should appear as an (1) outstanding check or (2) a deposit in transit.

e. Which check(s) may be indicative of kiting?

Figure 12-4

Step by Step Answer:

Modern Auditing

ISBN: 9780471542834

5th Edition

Authors: Walter Gerry Kell, William C. Boynton, Richard E. Ziegler