Alternative denominator-level capacity concepts effect on operating income. Lucky Lager has just purchased the Austin Brewery. The

Question:

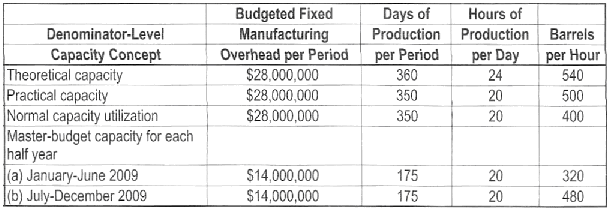

Alternative denominator-level capacity concepts effect on operating income. Lucky Lager has just purchased the Austin Brewery. The brewery is two years old and uses absorption costing. It will “sell” its product to Lucky Lager at $45 per barrel. Paul Brandon, Lucky Lager’s controller, obtains the following information about Austin Brewery’s capacity and budgeted fixed manufacturing costs for 2009:

1. Compute the budgeted fixed manufacturing overhead rate per barrel for each of the denominator-level capacity concepts. Explain why they are different.

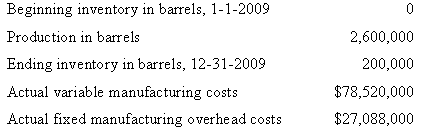

2. In 2009, the Austin Brewery reported these production results:

There are no variable cost variances. Fixed manufacturing overhead cost variances are written off to cost of goods sold in the period in which they occur. Compute the Austin Brewery’s operating income when the denominator-level capacity is (a) theoretical capacity, (b) practical capacity, and (c) normal capacity utilization.

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 978-0136126638

13th Edition

Authors: Charles T. Horngren, Srikant M.Dater, George Foster, Madhav