Heller Bottling Company began business in 2011. Inventory units purchased and sold for the first year of

Question:

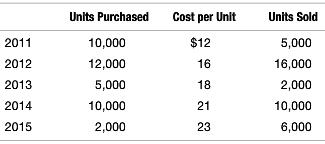

Heller Bottling Company began business in 2011. Inventory units purchased and sold for the first year of operations and each of the following four years follow:

Inadequate cash flows forced Heller Bottling Company to cease operations at the end of 2015.

a. Compute cost of goods sold for each of the five years if the company uses the following:

(1) LIFO cost flow assumption

(2) FIFO cost flow assumption

(3) Averaging cost flow assumption

b. Does the choice of a cost flow assumption affect total net income over the life of a business? Explain your answer.

c. If the choice of a cost flow assumption does not affect net income over the life of a business, how does the choice of LIFO give rise to a tax benefit?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: