The following disclosure was included in the footnotes of Caterpillars 2012 annual report. The company uses the

Question:

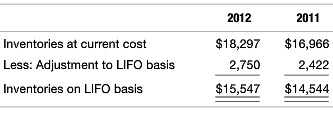

The following disclosure was included in the footnotes of Caterpillar’s 2012 annual report. The company uses the LIFO cost flow assumption and reported net income of $5,681 for 2012. The company’s effective tax rate is 31 percent (dollars in millions).

a. Compute 2012 ending inventory for Caterpillar assuming it changed from LIFO to FIFO at the end of 2012.

b. Compute the accumulated income tax savings enjoyed by Caterpillar due to the choice of LIFO as opposed to FIFO.

c. Compute 2012 reported net income for Caterpillar assuming it changed from LIFO to FIFO several years before.

d. Explain how the information generated in (a), (b), and (c) could be useful.

e. Explain why Caterpillar might oppose a requirement to adopt IFRS by U.S. companies.

The ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =...

Step by Step Answer: