In its 2012 annual report the Unilever Group, which published IFRS-based financial statements, reported the following in

Question:

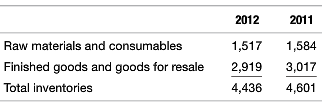

In its 2012 annual report the Unilever Group, which published IFRS-based financial statements, reported the following in the inventory footnote (in million euros).

“During 2012, 131 million euros (2011: 99 million euros) was charged to the income statement for damaged, obsolete, and lost inventories. In 2012, 71 million euros (2011: 43 million euros) was utilised or released to the income statement for inventory provisions taken in earlier years.”

a. Is Unilever a manufacturer or a retailer, and how do you know?

b. Does Unilever use the FIFO or LIFO inventory assumption, and how do you know?

c. What is an inventory write-down and an inventory recovery? Record the entries made by Unilever at the end of 2012 for the write-down and recovery.

d. How would Unilever’s accounting have been different if it used U.S. GAAP instead of IFRS?

Generally Accepted Accounting Principles (GAAP) is the accounting standard adopted by the U.S. Securities and Exchange Commission (SEC). While the SEC previously stated that it intends to move from U.S. GAAP to the International Financial Reporting Standards (IFRS), the...

Step by Step Answer: