Nevada Hydro is 40 percent debt-financed and has a weighted-average cost of capital of 9.7 percent: Banker?s

Question:

Nevada Hydro is 40 percent debt-financed and has a weighted-average cost of capital of 9.7 percent:

Banker?s Tryst Company is advising Nevada Hydro to issue $75 million of preferred stock at a dividend yield of 9 percent. The proceeds would be used to repurchase and retire common stock. The preferred issue would account for 10 percent of the preissue market value of the firm.

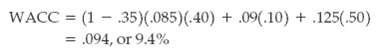

Banker?s Tryst argues that these transactions would reduce Nevada Hydro?s WACC to 9.4 percent:

Do you agree with this calculation? Explain.

Cost Of CapitalCost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Principles of Corporate Finance

ISBN: 978-0072869460

7th edition

Authors: Richard A. Brealey, Stewart C. Myers

Question Posted: