On January 1, 2011, Dataworx acquired 60% of the shares of Glider for $111,700. At this date,

Question:

On January 1, 2011, Dataworx acquired 60% of the shares of Glider for $111,700. At this date, the equity of

Glider consisted of:

Share capital......... $120,000

Retained earnings....... 40,000

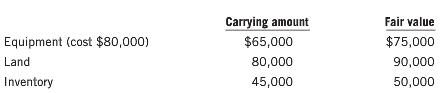

At this date, the identiï¬able assets and liabilities of Glider were recorded at fair value except for the following assets:

The equipment has a further ï¬ve-year life. Half the inventory on hand at the acquisition date was sold by December 31, 2011, with the remainder being sold in 2012. At December 31, 2013, the goodwill was written down by $3,000 as the result of an impairment test.

Dataworx uses the full goodwill method. The fair value of the non-controlling interest at January 1, 2011, was $74,100.

During the three years since acquisition, Glider has recorded the following annual results:

Year ended Proï¬t

December 31, 2011....... $15,000

December 31, 2012....... 27,000

December 31, 2013....... 12,000

There has been no dividend paid or declared by Glider since the acquisition date.

The equipment owned by Glider on January 1, 2011, was sold on June 30, 2012, for $70,000. The tax rate is 30%.

Required

(a) Prepare the consolidated ï¬nancial statement adjustments as at January 1, 2011.

(b) Prepare the consolidated ï¬nancial statement adjustments for the year ended December 31, 2011.

(c) Prepare the consolidated ï¬nancial statement adjustments for the year ended December 31, 2012.

(d) Prepare the consolidated ï¬nancial statement adjustments for the year ended December 31, 2013.

Goodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer: