State E applies a throwback rule to sales, while State F does not. State G has not

Question:

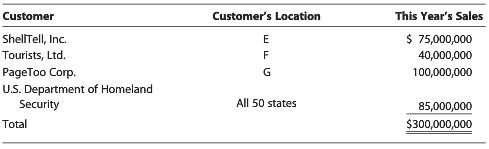

State E applies a throwback rule to sales, while State F does not. State G has not adopted an income tax to date. Clay Corporation, headquartered in E, reported the following sales for the year. All of the goods were shipped from Clay’s E manufacturing facilities.

a. Determine Clay’s sales factor in those states.

b. Comment on Clay’s location strategy using only your tax computations.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

South Western Federal Taxation 2016 Corporations Partnerships Estates And Trusts

ISBN: 9781305399884

39th Edition

Authors: James Boyd, William Hoffman, Raabe, David Maloney, Young

Question Posted: