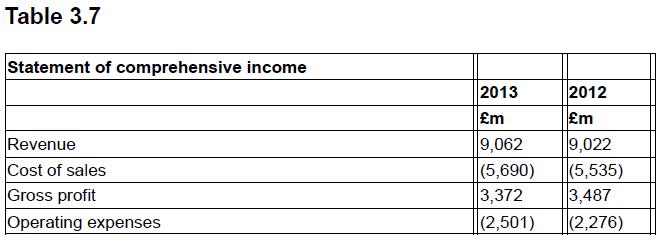

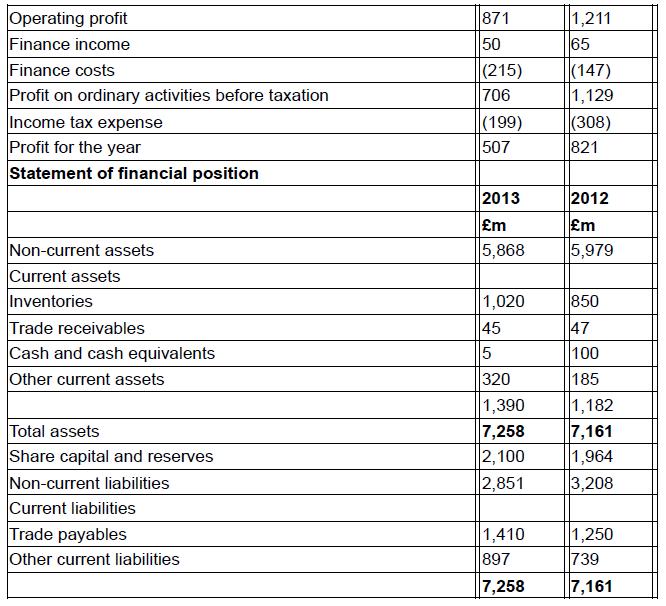

Extracts from the (summarized) financial statements of Barksdale plc, a retail group, for the year ended 31

Question:

Extracts from the (summarized) financial statements of Barksdale plc, a retail group, for the year ended 31 December 2013 are shown in Table 3.7 together with an extract from the chief executive’s report that accompanied their issue.

Extract from the chief executive’s report:

The year at a glance During the year we acted decisively to meet the challenges of the global economic downturn, taking steps to manage costs tightly and respond quickly to the changing needs of our customers. Our adjusted profits are down on last year to £507m. This is due in part to conditions on the High Street as well as our conscious decision to improve our value, without compromising our quality. We have built unrivalled trust in the Barksdale brand over the last 125 years, and will not sacrifice our core principles when times get tough. Though we have a strong emphasis on food, furniture and general merchandise, it is clothing that is our customers’ biggest discretionary purchase and as the UK’s leading clothing retailer, with the largest market share, it was inevitable that demand would ease off as customers reined in their spending. Although value market share is marginally down from 11.0 to 10.7 per cent, we have held our volume market share at 11.2 per cent. We believe this is evidence that our team are in tune with our customer base. We paid a dividend of £300 million during 2013 compared to £350 million which was paid out in 2012.

Required:

Based solely on the information provided above, you have been asked by a potential investor to analyse the position and performance of Barksdale plc.

Step by Step Answer:

Accounting And Finance For Managers A Decision Making Approach

ISBN: 9780749469139

1st Edition

Authors: Matt Bamber, Simon Parry