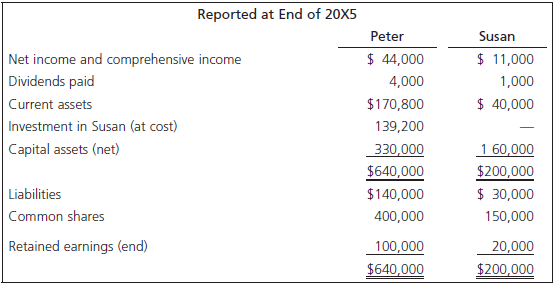

On January 1, 20X2, Peter Limited purchased 70% of the outstanding voting common shares of Susan Limited

Question:

Required

a. Calculate non-controlling interest in net income for 20X5 assuming consolidation is appropriate.

b. Calculate non-controlling interest in the consolidated statement of financial position as of the end of 20X5.

c. Calculate consolidated net income for 20X5 assuming a 10-year remaining life at acquisition date for capital assets and straight-line depreciation. Note that Peter Limited uses the cost method and that Susan Limited paid dividends during the year.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Advanced Financial Accounting

ISBN: 978-0132928939

7th edition

Authors: Thomas H. Beechy, V. Umashanker Trivedi, Kenneth E. MacAulay

Question Posted: