The following selected information is available for Jones & Co. Ltd., for the year ended 31 December

Question:

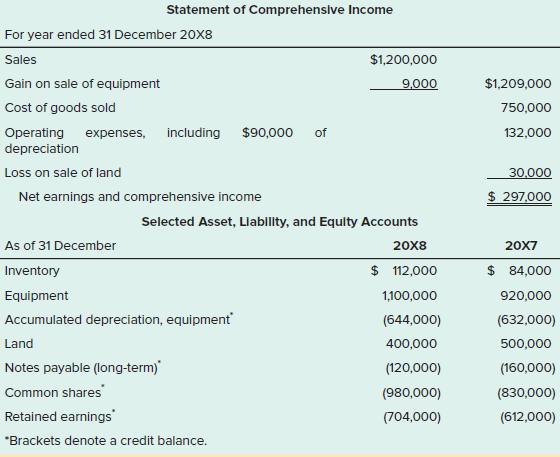

The following selected information is available for Jones & Co. Ltd., for the year ended 31 December 20X8:

Other Information:

1. Equipment with an original cost of $100,000 was sold for cash.

2. Other equipment was bought for cash.

3. There is no income tax expense.

4. Cash dividends were paid during the year as well as a $50,000 stock dividend that reduced retained earnings and increased common shares.

Required:

Present, in good form, the operating, investing, and financing section of the SCF for the year ended 31 December 20X8 as far as possible. Also list the non-cash transactions that would be separately disclosed. You have not been provided with enough information (cash, other assets, and liabilities) to balance the SCF to the change in cash.

Step by Step Answer:

Intermediate Accounting Volume 1

ISBN: 9781260306743

7th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod Dick