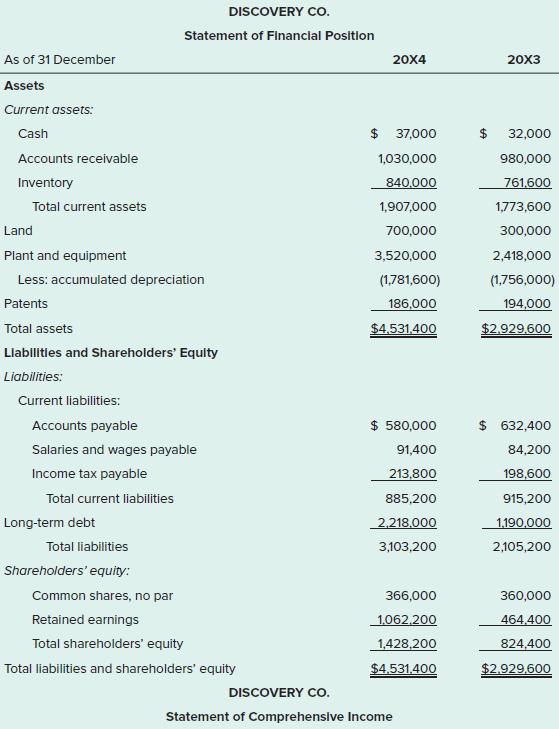

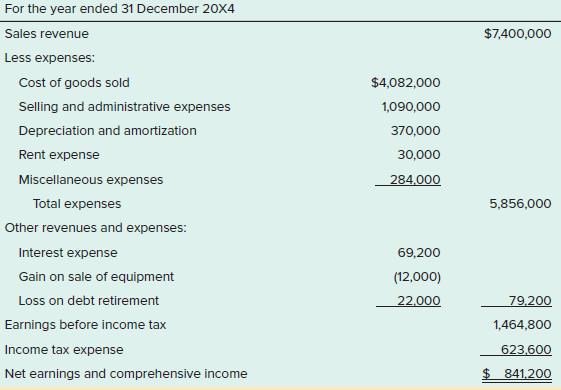

Financial statements for Discovery Co. follow: Additional information: a. The company sold equipment that had an original

Question:

Financial statements for Discovery Co. follow:

Additional information:

a. The company sold equipment that had an original cost of $584,000 and a net book value of $247,600. Other equipment was purchased for cash. Patent amortization was $8,000.

b. Long-term debt with a face value of $800,000 was repaid during the year and other long-term debt was issued at a lower interest rate.

c. The company issued shares for land during the period. Other common shares were retired (bought back and cancelled) at book value.

d. Assume unexplained changes in accounts stem from logical transactions.

Required:

1. Prepare the SCF, using the indirect method. Use the two-step method for operations. Omit the separate disclosure of cash flows for interest, investment income, and income tax.

2. Prepare the SCF, using the direct method to present cash flows in the operating activities section.

Step by Step Answer:

Intermediate Accounting Volume 1

ISBN: 9781260306743

7th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod Dick