Chess Ltd was incorporated on 1 September 20X4 and took over the business of Red and Green

Question:

Chess Ltd was incorporated on 1 September 20X4 and took over the business of Red and Green on 1 June 20X4. It was agreed that all profits made from 1 June should belong to the company and that the vendors should be entitled to interest on the purchase price from 1 June to the date of payment. The purchase price was paid on 31 October 20X4 including £3,300 interest.

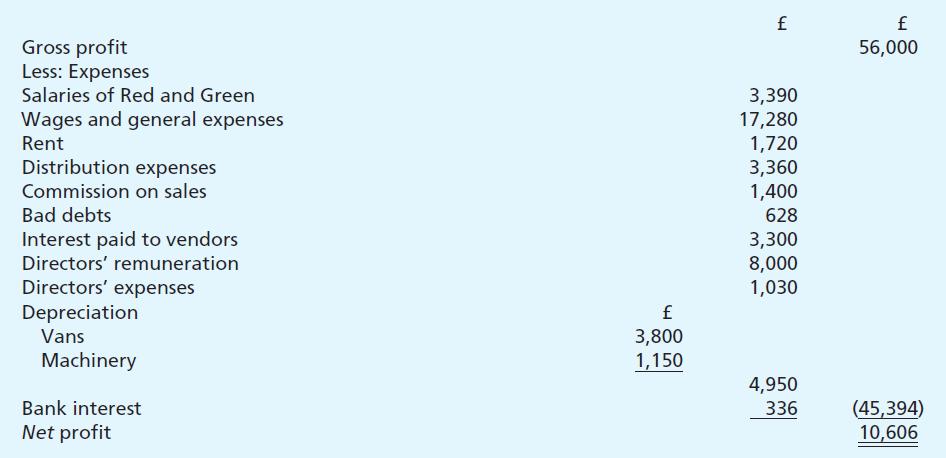

The following is the profit and loss account for the year to 31 May 20X5:

You are given the following information:

1. Sales amounted to £40,000 for the three months to 31 August 20X4 and £100,000 for the nine months to 31 May 20X5. Gross profit is at a uniform rate of 40 per cent of selling price throughout the year, and commission at a rate of 1 per cent is paid on all sales.

2. Salaries of £3,390 were paid to the partners for their assistance in running the business up to 31 August 20X4.

3. The bad debts written off are:

(a) A debt of £208 taken over from the vendors;

(b) A debt of £420 in respect of goods sold in November 20X4.

4. On 1 June 20X4, two vans were bought for £14,000 and machinery for £10,000. On 1 August 20X4 another van was bought for £6,000 and on 1 March 20X5, another machine was added for £6,000. Depreciation has been written off vans at 20 per cent per annum, and machinery 10 per cent per annum. Depreciation is written off for each month in which an asset is owned.

5. Wages and general expenses and rent all accrued at an even rate throughout the year.

6. The bank granted an overdraft facility in September 20X4.

Assuming all calendar months are of equal length:

(a) Set out the profit and loss account in columnar form, so as to distinguish between the period prior to the company’s incorporation and the period after incorporation;

(b) State how you would deal with the profit prior to incorporation;

(c) State how you would deal with the results prior to incorporation if they had turned out to be a net loss.

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9780273693109

10th Edition

Authors: Frank Wood, Alan Sangster