Margaret Boswell is another mortgage banker. Her firm faces problems similar to those facing Tracys firm. However,

Question:

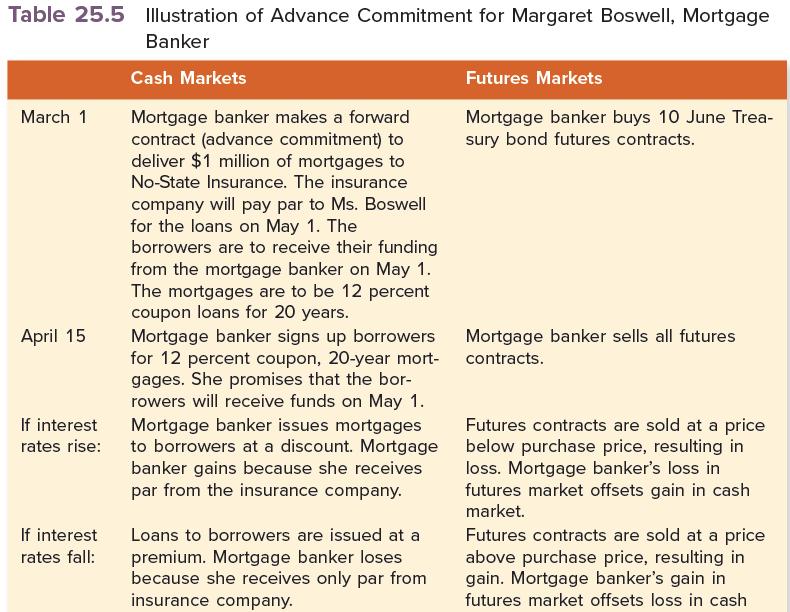

Margaret Boswell is another mortgage banker. Her firm faces problems similar to those facing Tracy’s firm. However, she tackles the problems through the use of advance commitments, a strategy that is the opposite of Tracy’s. That is, Margaret promises to deliver loans to a financial institution before she lines up borrowers. On March 1, her firm agreed to sell mortgages to No-State Insurance Co. The agreement specifies that she must turn over 12 percent coupon mortgages with a face value of $1 million to No-State by May 1.

No-State is buying the mortgages at par, implying that they will pay Margaret $1 million on May 1. As of March 1, Margaret had not signed up any borrowers. Over the next two months, she will seek out individuals who want mortgages beginning May 1.

As with Tracy, changing interest rates will affect Margaret. If interest rates fall before she signs up a borrower, the borrower will demand a premium on a 12 percent coupon loan. That is, the borrower will receive more than par on May 1.12 Because Margaret receives par from the insurance company, she must make up the difference.

Conversely, if interest rates rise, a 12 percent coupon loan will be made at a discount. That is, the borrower will receive less than par on May 1. Because Margaret receives par from the insurance company, the difference is pure profit to her. The details are provided in Table 25.5. As did Tracy, Margaret finds the risk burdensome.

Therefore, she offsets her advance commitment with a transaction in the futures markets.

Because she loses in the cash market when interest rates fall, she buys futures contracts to reduce the risk. When interest rates fall, the value of her futures contracts increases. The gain in the futures market offsets the loss in the cash market. Conversely, she gains in the cash markets when interest rates rise. The value of her futures contracts decreases when interest rates rise, offsetting her gain.

We call this a long hedge because Margaret offsets risk in the cash markets by buying a futures contract. Though it involves an interest rate futures contract, this long hedge is analogous to long hedges in agricultural and metallurgical futures contracts. We argued at the beginning of this chapter that individuals and firms institute long hedges when their finished goods are to be sold at a fixed price. Once Margaret makes the advance commitment with No-State Insurance, she has fixed her sales price. She buys a futures contract to offset the price fluctuation of her raw materials—that is, her mortgages.

Step by Step Answer:

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe