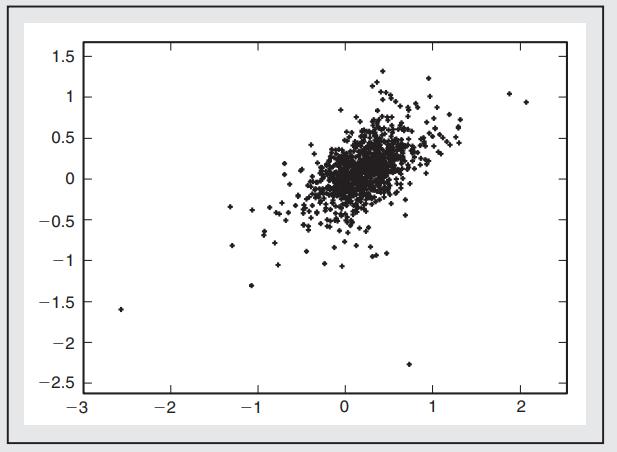

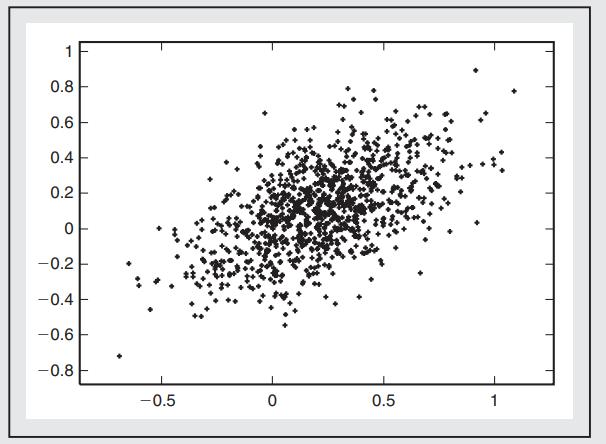

Examine the following plots of bivariate return distributions closely. Pay special attention to the values on the

Question:

Examine the following plots of bivariate return distributions closely. Pay special attention to the values on the axes. Both plots are joint distributions of returns of stocks. The first

Plot is from a Student’st distribution and the second one from a normal distribution. Both have the same means and covariance matrices. Explain which joint return distribution is likely to be riskier in terms of VaR. Why are they different in risk even though the means, variances, and covariances are the same?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: