You are given a portfolio of two assets whose returns are jointly normally distributed with the following

Question:

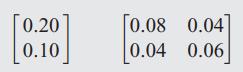

You are given a portfolio of two assets whose returns are jointly normally distributed with the following mean vector and covariance matrix:

(a) Compute the 95% VaR of the portfolio if $1 is invested in the first asset and $1 is invested in the second.

(b) Compute the risk-contribution of each asset to the VaR.

(c) Is the current portfolio weighting optimal? If not, suggest a better one.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

a We use the usual computations in Octave as before to develop the VaR b The risk c...View the full answer

Answered By

Somshukla Chakraborty

I have a teaching experience of more than 4 years by now in diverse subjects like History,Geography,Political Science,Sociology,Business Enterprise,Economics,Environmental Management etc.I teach students from classes 9-12 and undergraduate students.I boards I handle are IB,IGCSE, state boards,ICSE, CBSE.I am passionate about teaching.Full satisfaction of the students is my main goal.

I have completed my graduation and master's in history from Jadavpur University Kolkata,India in 2012 and I have completed my B.Ed from the same University in 2013. I have taught in a reputed school of Kolkata (subjects-History,Geography,Civics,Political Science) from 2014-2016.I worked as a guest lecturer of history in a college of Kolkata for 2 years teaching students of 1st ,2nd and 3rd year. I taught Ancient and Modern Indian history there.I have taught in another school in Mohali,Punjab teaching students from classes 9-12.Presently I am working as an online tutor with concept tutors,Bangalore,India(Carve Niche Pvt.Ltd.) for the last 1year and also have been appointed as an online history tutor by Course Hero(California,U.S) and Vidyalai.com(Chennai,India).

4.00+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Engineering questions

-

You are given a portfolio of three assets whose returns are jointly normally distributed with the following mean vector and covariance matrix: (a) Compute the 95% VaR for the portfolio if we invest...

-

The Argo Hedge fund has the following portfolio of options of the XYZ stock Type Position Delta of Option Gamma of Option Call 1,000 0.50 0.2 Call 500 0.80 0.6 Put 2,000 0.40 1.3 Call 500 0.70 1 A...

-

You are given a portfolio of three assets with mean vector and covariance matrix of returns as follows: Compute the 95% VaR for a portfolio that is invested in $1 in each asset using the delta-normal...

-

Create a weighted scoring model to determine grades for a course. Final grades are based on three exams worth 20%, 15%, and 25%, respectively; homework is worth 15%; and a group project is worth 25%....

-

The local oscillator used for the demodulation of an SSB signal s (t) has a frequency error measured with respect to the carrier frequency c used to generate s (t). Otherwise, there is perfect...

-

Consider the conditions of Problem 9.19, but now allow for a difference between the inner and outer surface temperatures, Ts,i and Ts,o of the window. For a glass thickness and thermal conductivity...

-

An airplane flies at \(150 \mathrm{~km} / \mathrm{hr}\). (a) The airplane is towing a banner that is \(b=0.8 \mathrm{~m}\) tall and \(\ell=25 \mathrm{~m}\) long. If the drag coefficient based on area...

-

Lowes Companies, Inc. (LOW) and its subsidiaries operate as a home improvement retailer in the United States and Canada. As of February 1, 2008, it operated 1,534 stores in 50 states and Canada. The...

-

Osborn Manufacturing uses a predetermined overhead rate of $18.60 per direct labor-hour. This predetermined rate was based on a cost formula that estimates $230,640 of total manufacturing overhead...

-

The following asset-pricing factor returns are downloaded from the FamaFrench database: the excess market return, the SMB portfolio return, the HML portfolio return, and the risk-free return. From...

-

Examine the following plots of bivariate return distributions closely. Pay special attention to the values on the axes. Both plots are joint distributions of returns of stocks. The first Plot is from...

-

No one should buy clothing at a department store without first trying it on. Accordingly, no one should buy food at a grocery store without first tasting it. Identify the fallacies of weak induction...

-

What is unearned revenue? Provide three examples of unearned revenue.

-

Under what circumstances will deferred taxes likely result in a cash outflow?

-

What is the concept of pro forma income and why has this income measure been criticized?

-

What effect, if any, does a weakening \$US have on reported sales and net income for companies operating outside the United States?

-

On January 1 of the current year, Yetman Company purchases \(40 \%\) of the common stock of Livnat Company for \(\$ 500,000\) cash. This \(40 \%\) ownership allows Yetman to exert significant...

-

Prepare a cash flow projection for a construction company that currently has two projects under contract for the next year and anticipates picking up a third and fourth project during the year. For...

-

On October 1, 2021, Adoll Company acquired 2,600 shares of its $1 par value stock for $38 per share and held these shares in treasury. On March 1, 2023, Adoll resold all the treasury shares for $34...

-

An important rule is that you should never show a nominal rate on a time line or use it in calculations unless what condition holds? (Hint: think of annual compounding, when iNom = EAR = iPer.) What...

-

Suppose someone offered to sell you a note calling for the payment of $1,000 15 months from today. They offer to sell it to you for $850. You have $850 in a bank time deposit which pays a 6.76649...

-

What are the key features of a bond? MINI CASE Sam Struthers and Shawna Tibbs are vice-presidents of Mutual of Seattle Insurance Company and co-directors of the company's pension fund management...

-

Oriole Corporation purchased equipment very late in 2023. Based on generous capital cost allowance rates provided in the Income Tax Act, Oriole claimed CCA on its 2023 tax return but did not record...

-

Callisto Company manufactures chemical additives for industrial applications. As the new cost accountant for Callisto, you have been assigned the task of completing the production cost report for the...

-

Tartufo Corp. entered into a 5-year lease agreement with Gelato Inc. to lease equipment beginning on January 1, 20X5. The IBR is 9% while the rate implicit in the lease is 8%. Tartufo Corp. Is aware...

Study smarter with the SolutionInn App