You are given a portfolio of three assets whose returns are jointly normally distributed with the following

Question:

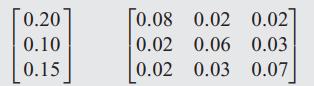

You are given a portfolio of three assets whose returns are jointly normally distributed with the following mean vector and covariance matrix:

(a) Compute the 95% VaR for the portfolio if we invest $1 in the first asset, $2 in the second asset, and $3 in the third asset.

(b) How much does each asset’s holding contribute to the overall VaR risk?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: