Though shares in Minor plc were quoted on this day at 145p each, Major plc paid 680,000

Question:

Though shares in Minor plc were quoted on this day at 145p each, Major plc paid £680,000 to acquire 400,000 ordinary shares of £1 each in Minor plc on 1 April 2010 when:

(i) Minor’s retained loss amounted to £60,000; and

(ii) The fair value of property, plant and equipment held by Minor was £600,000, though that of its investments was £25,000.

On the day of acquisition Major acquired at par £100,000 8% Loan notes issued by Minor.

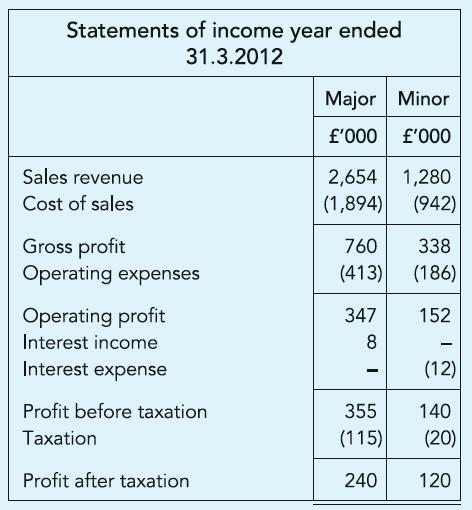

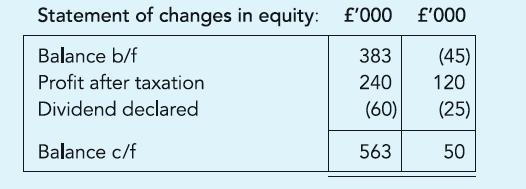

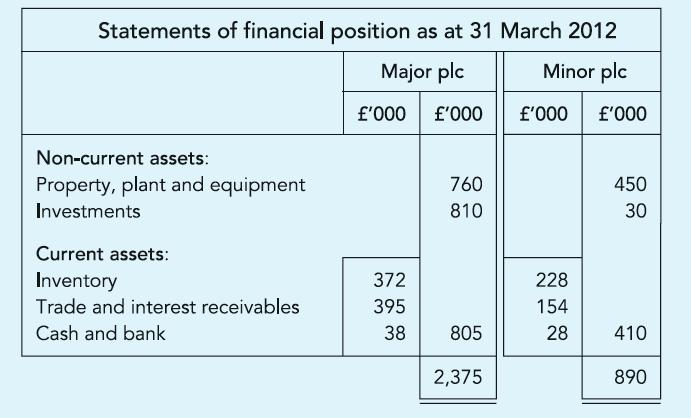

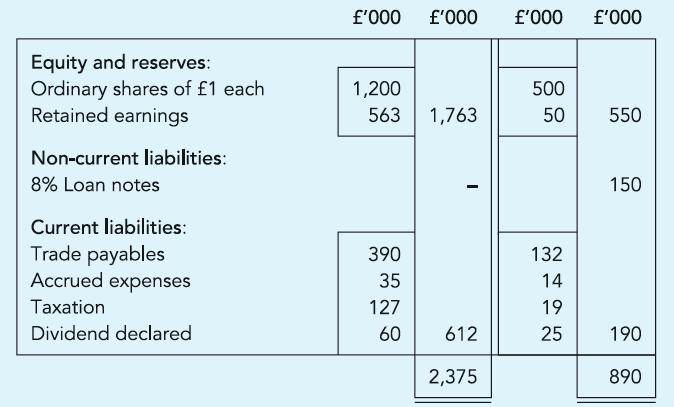

The Statements of income for the year ended 31 March 2012 have been prepared by both companies, as shown, and the Statements of financial position as set out and below.

Further information is available as follows:

(a) Based on fair value Minor needs to write off additional depreciation amounting to £5,000 p.a.

(b) Interest payable on the loan notes has been accrued by both companies, but remains unpaid.

(c) During the year ended 31 March 2012 Minor plc invoiced goods to Major plc at £180,000. Minor invoices Major at prices calculated produce a gross profit of 25%. The amount invoiced in the year includes those invoiced at £20,000 not received by Major until 4 April 2012.

(d) Inventory held by Major, as at the year-end, includes goods invoiced by Minor at £40,000.

(e) Trade payables reported by Major includes £65,000 owed to Minor. Corresponding amount reported by Minor is £90,000. The difference, unless explained otherwise, may be attributed to cash in transit.

(f) Major plc has not accounted for the dividend declared by Minor plc.

(g) Fair value of goodwill in Minor, as at 31 March 2012, is estimated at £200,000.

Required:

Prepare the Consolidated Statement of income for the Major group for the year ended 31 March 2012 and the Consolidated Statement of financial position as at that date.

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict