Jean Smith, who retails wooden ornaments, has been so busy since she commenced business on 1 April

Question:

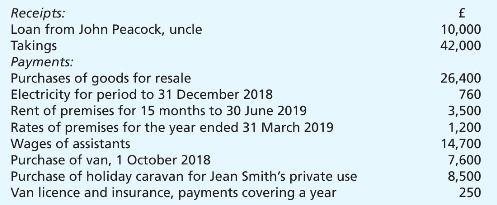

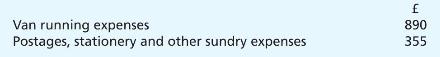

Jean Smith, who retails wooden ornaments, has been so busy since she commenced business on 1 April 2018 that she has neglected to keep adequate accounting records. Jean's opening capital consisted of her life savings of \(£ 15,000\) which she used to open a business bank account. The transactions in this bank account during the year ended 31 March 2019 have been summarised from the bank account as follows:

According to the bank account, the balance in hand on 31 March 2019 was \(£ 4,090\) in Jean Smith's favour.

While the intention was to bank all takings intact, it now transpires that, in addition to cash drawings, the following payments were made out of takings before bankings:

On 31 March 2019, takings of \(£ 640\) awaited banking; this was done on 1 April 2019. It has been discovered that amounts paid into the bank of \(£ 340\) on 29 March 2019 were not credited to Jean's bank account until 2 April 2019 and a cheque of \(£ 120\), drawn on 28 March 2019 for purchases, was not paid until 10 April 2019. The normal rate of gross profit on the goods sold by Jean Smith is \(50 \%\) on sales. However, during the year a purchase of ornamental goldfish costing \(£ 600\) proved to be unpopular with customers and therefore the entire inventory had to be sold at cost price.

Interest at the rate of \(5 \%\) per annum is payable on each anniversary of the loan from John Peacock on 1 January 2019.

Depreciation is to be provided on the van on the straight-line basis; it is estimated that the van will be disposed of after five years' use for \(£ 100\).

The inventory of goods for resale at 31 March 2019 has been valued at cost at \(£ 1,900\).

Trade payables for purchases at 31 March 2019 amounted to \(£ 880\) and electricity charges accrued due at that date were \(£ 180\).

Trade receivables at 31 March 2019 totalled £2,300.

\section*{Required:}

Prepare an income statement for the year ending 31 March 2019 and a balance sheet as at that date.

Step by Step Answer:

Frank Woods Business Accounting An Introduction To Financial Accounting

ISBN: 9781292365435

15th Edition

Authors: Alan Sangster, Lewis Gordon, Frank Wood