Kendall and Harvey are in partnership as wholesalers of novelty products. They share residual profits in the

Question:

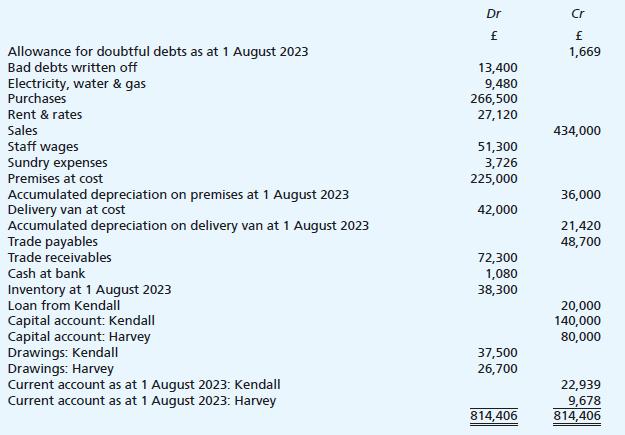

Kendall and Harvey are in partnership as wholesalers of novelty products. They share residual profits in the ratio 5:3. The trial balance exhibited below was extracted from the nominal ledger of their business as at 31 July 2024:

The following nine matters also need to be considered before preparing the financial statements of the partnership:

(i) Inventory was counted on 31 July 2024 and was valued at a cost of £42,900.

(ii) Depreciation needs to be charged on the premises at 2% straight line and on the delivery van at 30% reducing balance.

(iii) The costs of electricity, water and gas used in July 2024 for which no invoices have yet been received are estimated to total £4,200.

(iv) The amount for rent and rates on the trial balance includes a payment of £3,300 which represented three months’ rent for the quarter ending 30 September 2024.

(v) The allowance for doubtful debts is, based on an analysis of the business’s experience in recent years, to be set at 3% of trade receivables.

(vi) Kendall’s loan to the partnership is repayable in seven years’ time and attracts interest at a rate of 6% per year.

(vii) Interest on drawings for the year have been calculated to amount to £170 for Kendall and £130 for Harvey.

(viii) Both partners are entitled to interest on capital at an annual rate of 5%.

(ix) Kendall and Harvey are entitled to annual salaries of £15,000 and £10,000 respectively.

Required:

Prepare an income statement and appropriation account for the year ended 31 July 2024 as well as a balance sheet as at that date.

Step by Step Answer:

Frank Woods Business Accounting An Introduction To Financial Accounting

ISBN: 9781292365435

15th Edition

Authors: Alan Sangster, Lewis Gordon, Frank Wood