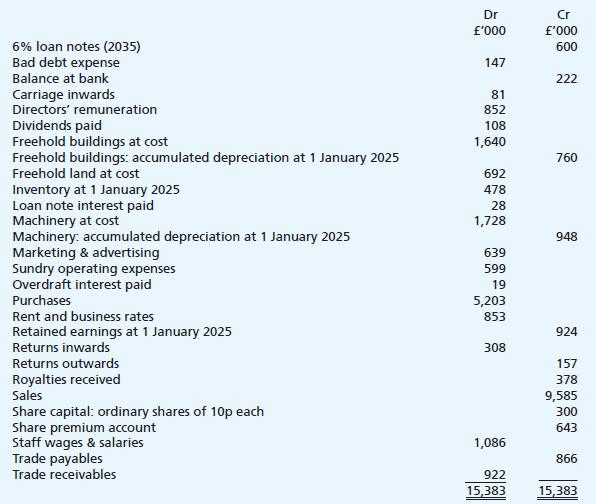

The trial balance for Unsworton plc as at 31 December 2025 is as follows: Additional information: (i)

Question:

The trial balance for Unsworton plc as at 31 December 2025 is as follows:

Additional information:

(i) Two accounting errors have just been discovered that have not yet been corrected:

• A purchase credit note for £16,000 from a supplier has been recorded twice by mistake during December 2025.

• A contra (or ‘set-off’) of £7,000 needed between a receivable and a payable has not been recorded in the nominal ledger.

(ii) Inventory at 31 December 2025 was counted and valued at a cost of £517,000.

(iii) Depreciation is to be charged at the following annual rates:

• freehold buildings - 2.5% straight line • machinery - 15% reducing balance.

(iv) Rent and business rates include a payment of £195,000 in respect of rent for the quarter ending 31 January 2026.

(v) The audit fee for 2025 has been agreed at £95,000 and this needs to be provided for.

(vi) On 1 January 2025, Unsworton plc had £500,000 8% loan notes in issue, interest being paid halfyearly on 30 June and 31 December. On 31 March 2025, the company redeemed all £500,000 of these loan notes at par, paying the interest due up to that date. On 1 April 2025, the company then issued £600,000 6% loan notes at par, interest being payable half-yearly on 30 September and 31 March.

(vii) During October 2025, the company made a 1-for-4 bonus issue of its 10p ordinary shares.

The directors had intended to use the share premium account for this. However, no entries whatsoever have yet been made in respect of the issue.

(viii) During November 2025, the freehold land was valued at £1.1m by a professional firm of valuers.

The directors of Unsworton plc wish to incorporate this valuation in the financial statements.

(ix) The corporation tax due on the profit for the year is estimated to be £41,000 (this estimate is unaffected by the various matters above).

Required:

Prepare, in a publishable format, the income statement for Unsworton plc for the year ended 31 December 2025 and the balance sheet as at that date.

Step by Step Answer:

Frank Woods Business Accounting An Introduction To Financial Accounting

ISBN: 9781292365435

15th Edition

Authors: Alan Sangster, Lewis Gordon, Frank Wood