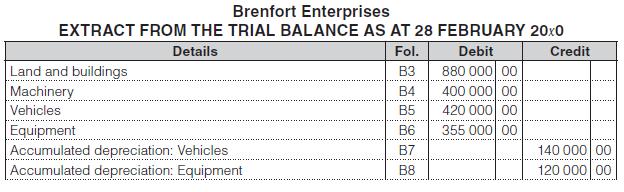

1. Vehicles are depreciated at 20% per annum on the straight-line basis. 2. Residual value is based...

Question:

1. Vehicles are depreciated at 20% per annum on the straight-line basis.

2. Residual value is based on a 30% of the cost of vehicles.

3. Land and buildings are not depreciated.

4. Depreciation on equipment is calculated at 20% per annum on the diminishing-balance method.

5. Depreciation on machinery is calculated based on the number of units that the machine produces. (See note relating to machine below.)

6. No depreciation has been calculated for machinery in the current year.

Old assets:

• The machine in the trial balance was bought (and brought into use) on 15 August 19x8 at a total cost of R400 000 with no residual value.

• The machine had a capacity to complete/produce 35 000 units.

• For the years ending 28 February 19x9, 20x0 and 20x1, the number of units produced was 7 000, 14 000 and 10 500 units in the three respective years.

New assets bought:

A New vehicle: 31 May 20x0

– A new car was bought from Mart Motors for R153 000.

– 85% of the purchase price of the car was financed through Nedfin Bank. The other 15% was settled in cash.

– The car was available for use on the same day.

B New machine: 30 June 20x0

– Purchased a new machine from Machine Manufacturers (Pty) Ltd on credit for R293 000.

– The machine was delivered to Machine Modification on the same day. A stabiliser was fitted to the machine to ensure that the machine would be suitable for use in the factory.

– The cost of the stabiliser was R63 000 and was settled in cash.

– The business also paid labour for the conversion, R12 000.

– It has been estimated that the machine will be able to produce 50 000 units.

– In the current year, a total of 8 000 units was produced from the day that the machine was brought into use.

You are required to:

1. Record the transactions and depreciation in the general journal as at 28 February 20x1.

2. Process the following ledger accounts for the year ended 28 February 20x1:

3. Prepare these general ledger accounts:

a. Machinery.

b. Accumulated depreciation: machinery.

Opening balances are required.

4. Show how the non-current assets would be shown in the statement of financial position as at 28 February 20x1.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit