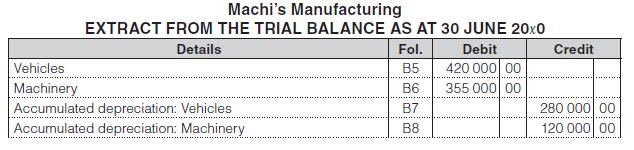

1. Vehicles are depreciated at 20% per annum on the straight-line basis. 2. The business considers the...

Question:

1. Vehicles are depreciated at 20% per annum on the straight-line basis.

2. The business considers the residual value of the vehicles to be 35% on cost.

3. Depreciation on machinery is calculated at 15% per annum on the diminishing-balance method.

4. No depreciation has been recorded for the current year.

Transactions for the year ended 30 June 20x1:

A New machine: 1 September 20x0

– Purchased a new machine from MA Transformers for R120 000 and paid a 10% deposit.

– Purchased a crane for the machine and issued a cheque for R18 000.

– Entered into a monthly maintenance contract with Maintain My Machine for R2 500 per month.

– Maintenance will begin one month after the machine is brought into use.

– On 1 October 20x0, the machine was available for use and brought into use after incurring a installation cost of R20 000 on the machine. The installation cost was settled by cheque.

B New vehicle: 1 December 20x0

– Purchased a new truck that cost R242 000 from Road Truckers and financed 80% of the cost with a loan from ABASA Bank. The balance was paid by cheque.

– On the same day, a hydraulic pump was fitted and settled in cash for R18 000.

– Paid the licensing of R800 to the SA Traffic department.

– The asset was available for use the next day.

– On 1 June 20x1, paid for the service of the truck by cheque, R4 800.

You are required to:

1. Record the transactions and depreciation in the general journal as at 30 June 20x1.

2. Show how the above totals should be shown on the statement of profit or loss & other comprehensive income and the statement of financial position for the year ended 30 June 20x1.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit