1. Vehicles are depreciated at 20% per annum on the straight-line basis. 2. The business considers the...

Question:

1. Vehicles are depreciated at 20% per annum on the straight-line basis.

2. The business considers the residual value on the vehicles to be 25% on cost.

3. Depreciation on equipment is calculated at 20% per annum on the diminishing-balance method.

4. Depreciation on machinery is calculated based on the units that the machine produces.

5. No depreciation has been recorded for the current year.

6. All amounts are VAT inclusive, unless otherwise stated.

7. All suppliers are considered to be registered VAT vendors.

Old assets:

• The machine in the trial balance was bought (and brought into use) on 15 May 19x9 at a total cost of R500 000 with no residual value.

• The machine had a capacity to complete/produce 55 000 units.

• For the years ending 28 February 20x0, 20x1 and 20x2 the number of units produced was 11 000, 14 000 and 15 000 units in the three respective years.

• On 28 February 20x2, Titus Enterprises sold this machine for R83 000 (VAT excl.) to Mac- Peters Burgers.

• The accountant was unfamiliar with the depreciation process and, therefore, has not processed any of the depreciation entries for the machine from the day it was brought into use.

New assets bought:

A Machinery: 30 April 20x1

– Titus Enterprise ordered and paid R433 200 for a machine imported from Germany.

– On arrival, the machine was delivered to Fix-My-Machine on the same day. A stabiliser was fitted to the machine to ensure that the machine would be suitable for use in the factory.

– The cost of the stabiliser was R73 000 (VAT excluded) and was settled in cash.

– The business also paid a labour cost of R18 240 for the conversion of the machine.

– It has been estimated that the machine will be able to produce 40 000 units.

– In the current year, a total of 6 000 units was produced from the day that the machine was brought into use.

B Vehicle: 31 July 20x1

– A new car was bought from SI-SI-PHO Motors for an amount of R250 800.

– A 20% deposit was paid on date of purchase and the balance is to financed by a loan from Wentzel Bank.

– The vehicle was available for use on 31 August 20x1 after acquiring the necessary finance, but only brought into use on 19 September 20x1

Assets sold:

C Vehicle: 30 November 20x1

– Sold a vehicle for R125 400.

– The vehicle was bought on 1 May 19x9 at a total cost of R160 000 (VAT excluded) and was available for use on the same day.

You are required to

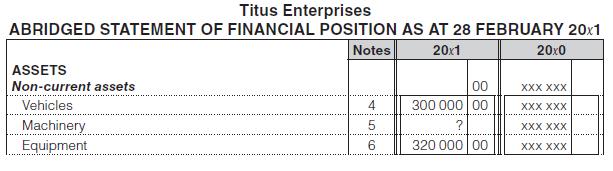

1. Record the transactions and depreciation in the general journal as at 28 February 20x2.

2. Complete the non-current assets note in the financial statements as at 28 February 20x2.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit