On January 1, 2027, Plutonium Corporation acquired 80% of the outstanding stock of Sulfurst Inc. for $268,000

Question:

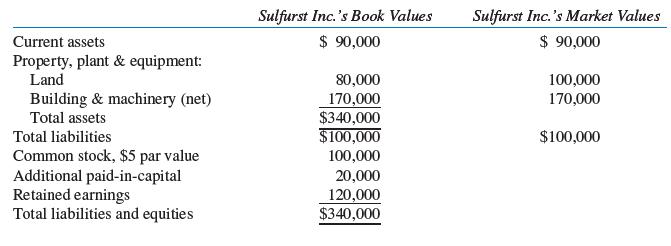

On January 1, 2027, Plutonium Corporation acquired 80% of the outstanding stock of Sulfurst Inc. for $268,000 cash. The following balance sheet shows Sulfurst Inc.’s book values immediately prior to acquisition, as well as the appraised values of its assets and liabilities by Plutonium’s experts.

Required:

A. Prepare a Computation and Allocation Schedule for the Difference between Book Value and the Value Implied by the Purchase Price.

B. Prepare the entry to be made on the books of Plutonium Corporation to record its investment in Sulfurst Inc.

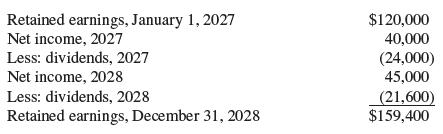

Assume that during the first two years after acquisition of Sulfurst Inc., Sulfurst reports the following changes in its retained earnings:

C. Prepare journal entries under each of the following methods to record the information above on the books of Plutonium Corporation for the years 2027 and 2028, assuming that all depreciable assets have a remaining life of 20 years.

1. Plutonium uses the cost method to account for its investment in Sulfurst.

2. Plutonium uses the partial equity method to account for its investment in Sulfurst.

3. Plutonium uses the complete equity method to account for its investment in Sulfurst.

Step by Step Answer: