Eight independent situations are described below. Each involves future deductible amounts and/or future taxable amounts ($ in

Question:

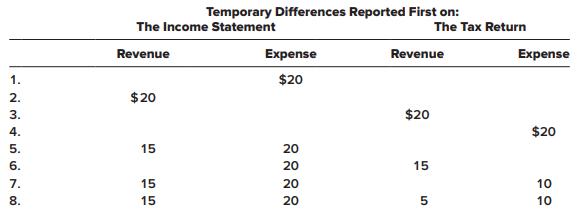

Eight independent situations are described below. Each involves future deductible amounts and/or future taxable amounts ($ in millions).

Required:

For each situation, determine taxable income, assuming pretax accounting income is $100 million.

Transcribed Image Text:

Temporary Differences Reported First on: The Income Statement The Tax Return Revenue Expense Revenue Expense 1. $20 2. $20 3. $20 4. $20 5. 15 20 6. 20 15 7. 15 20 10 8. 15 20 10

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (9 reviews)

Temporary difference Temporary d...View the full answer

Answered By

Felix Onchweri

I have enough knowledge to handle different assignments and projects in the computing world. Besides, I can handle essays in different fields such as business and history. I can also handle both short and long research issues as per the requirements of the client. I believe in early delivery of orders so that the client has enough time to go through the work before submitting it. Am indeed the best option that any client that can think about.

4.50+

5+ Reviews

19+ Question Solved

Related Book For

Intermediate Accounting

ISBN: 9781259722660

9th Edition

Authors: J. David Spiceland, James Sepe, Mark Nelson, Wayne Thomas

Question Posted:

Students also viewed these Business questions

-

Four independent situations are described below. Each involves future deductible amounts and/or future taxable amounts produced by temporary differences: The enacted tax rate is 25%. Required: For...

-

Two independent situations are described below. Each involves future deductible amounts and/ or future tax-able amounts produced by temporary differences: The enacted tax rate is 40% for both...

-

Four independent situations are described below. For each, annual lease payments of $100,000 (not including any executory costs paid by lessor) are payable at the beginning of each year. Each is a...

-

Calculate the numerical value of cross-price elasticity, exy, in each of the following situations. Do not round your interim calculations before obtaining the final solution (i.e. do not clear your...

-

Early Bird Bakeries Ltd. (EBB) is planning to pay a special dividend per share, over and above its regular quarterly dividend, at the end of the fourth quarter of 2012. EBB ended 2009 with retained...

-

Party Wagon, Inc., provides musical entertainment at weddings, dances, and various other functions. The company performs adjusting entries monthly, but prepares closing entries annually on December...

-

The spacing between atomic planes in a crystal is \(0.110 \mathrm{~nm}\). If \(12.0 \mathrm{keV} \mathrm{x}\) rays are diffracted by this crystal, what are the angles of (a) first-order and (b)...

-

The following are comparative balance sheets for Mitch Company. Additional information: 1. Net income for 2017 was $93,000. 2. Depreciation expense was $34,000. 3. Cash dividends of $39,000 were...

-

Following are the transactions of a new company called Pose-for-Pics. August 1 M. Harris, the owner, invested $12,500 cash and $53,750 of photography equipment in the company in exchange for common...

-

This year, Jack O. Lantern incurred a $60,000 loss on the worthlessness of his stock in the Creepy Corporation (CC). The stock, which Jack purchased in 2005, met all of the 1244 stock requirements at...

-

Listed below are 10 causes of temporary differences. For each temporary difference indicate the balance sheet account for which the situation creates a temporary difference. Temporary Difference 1....

-

When a company records a deferred tax asset, it may need to also report a valuation allowance if it is more likely than not that some portion or all of the deferred tax asset will not be realized....

-

Write each number as a product of a real number and i. Simplify all radical expressions. V-21

-

At its core, an Appreciative Inquiry worldview would stand in stark opposition to unethical practice, which could explain why scarcely little is available in print that discusses the need for ethical...

-

VonTesler Enterprises Inc. provides equipment and service solutions to a variety of small and midsized business customers throughout the northeastern United States. VonTesler Enterprises Inc. is...

-

Define what a "transactional" relationship is, and discuss how this occurs in logistics.

-

Company X is looking for $100,000 to purchase new equipment. The finance manager for Company X recently presented financial reports. Upon further analysis of the statements, you, the banker, noted...

-

Harry Cavill is the business owner of Festive Delights which manufactures and sells Christmas Baubles. Harry is excited about the upcoming Christmas period because, for the last five years, December...

-

Starbucks opened its first store in Zagreb, Croatia in October 2010. The price of a tall vanilla latte in Zagreb is 25.70kn. In New York City, the price of a tall vanilla latte is $2.65. The exchange...

-

You have just begun your summer internship at Omni Instruments. The company supplies sterilized surgical instruments for physicians. To expand sales, Omni is considering paying a commission to its...

-

Unit, Group, and Composite Depreciation The certified public accountant is frequently called upon by management for advice regarding methods of computing depreciation. Of comparable importance,...

-

Unit, Group, and Composite Depreciation The certified public accountant is frequently called upon by management for advice regarding methods of computing depreciation. Of comparable importance,...

-

DepreciationStrike, Units-of-Production, Obsolescence Presented below and are three different and unrelated situations involving depreciation accounting. Answer the question(s) at the end of each...

-

Greenwood Company manufactures two products-15,000 units of Product Y and 7,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering...

-

1. In his job, Martin is handed several bricks. He carries them across a yard and hands them to a bricklayer. He thinks he works hard, but his sister tells him that he does not work on the bricks....

-

12-19. A train starts from rest at station A and accelerates at 0.5 m/s for 60 s. Afterwards it travels with a constant velocity for 15 min. It then decelerates at 1 m/s until it is brought to rest...

Study smarter with the SolutionInn App