Tornado Corporation (a U.S.-based company) acquired 100 percent of a Canadian company for 16 million Canadian dollars

Question:

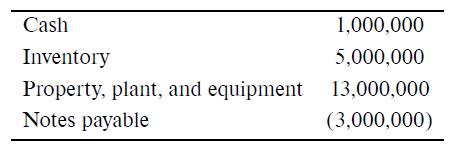

Tornado Corporation (a U.S.-based company) acquired 100 percent of a Canadian company for 16 million Canadian dollars on December 20, Year 1. At the date of acquisition, the exchange rate was US$0.75 per Canadian dollar. The acquisition price is attributable to the following assets and liabilities denominated in Canadian dollars:

Tornado Corporation prepares consolidated financial statements on December 31, Year 1. By that date, the Canadian dollar appreciated to US$0.78. Because of the year-end holidays, no transactions took place between the date of acquisition and the end of the year. Property, plant, and equipment is depreciated using a units-of-production method, so no depreciation is required from December 20 to December 31. The Canadian subsidiary has no revenues and no expenses from December 20 to December 31, and its book value is unchanged from December 20 to December 31.

Required:

a. Determine the translation adjustment to be reported on Tornado’s December 31, Year 1, consolidated balance sheet, assuming that the Canadian dollar is the Canadian subsidiary’s functional currency. What is the economic relevance of this translation adjustment?

b. Determine the remeasurement gain or loss to be reported in Tornado’s Year 1 consolidated income, assuming that the U.S. dollar is the functional currency. What is the economic relevance of this remeasurement gain or loss?

Step by Step Answer:

International Accounting

ISBN: 9781264556991

6th Edition

Authors: Timothy Doupnik, Mark Finn, Giorgio Gotti And Hector Perera