Catherine Big has a cash balance of 52,900 on 1 June 20X9. She opens a current account

Question:

Catherine Big has a cash balance of £52,900 on 1 June 20X9. She opens a current account on that date, with Belfast Bank, depositing £50,000. Her transactions during the next three days included the following:

1 June

• Cash sales £4,500.

• Received a cheque for £25,200 from Sean Dargan, a customer.

• Paid £2,400 as rent by cheque number 0001.

• Paid £48 as wages in cash.

• Paid the petty cashier £168 as the week’s imprest. The petty cashier has a cash float of £500 at

the beginning of each week and has produced vouchers to the cashier to evidence the payment

out of petty cash of £168 in the last week of May.

• Deposited all amounts into bank, leaving a cash float with the cashier of £4,000.

2 June

• Paid £76 for stationery by cheque number 0002.

• Cash sales £3,680.

• £9,600 is paid as business rates by a standing order.

• Paid £290 for electricity by cheque number 0003.

• Paid £72 as wages in cash.

• Received a cheque for £36,800 from Tony Kirk, a customer.

• Deposited all amounts into bank, retaining a float of £4,000.

3 June

• Sean Dargan’s cheque for £25,200 is returned to Catherine Big marked ‘refer to drawer’.

Catherine telephoned Sean, who apologized that he was temporarily short of funds and

requested Catherine to re-present the cheque to the bank on 4 June.

• The bank approves a loan to the business of £20,000. Catherine is informed that this is lodged to

the current account.

• Paid £56,000 for a car by cheque number 0004.

• Wrote cheque number 0005 to draw £1,200 in cash for office use.

• Catherine drew £2,000 cash for her personal use.

Required

a. Write up the cash account and the bank account.

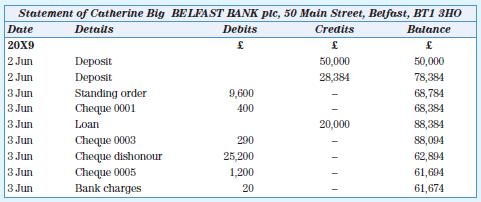

Catherine Big receives the following bank statement on 4 June:

Required

b. Prepare the bank reconciliation as at 3 June 20X9.

Step by Step Answer:

Introduction To Financial Accounting

ISBN: 9781526803009

9th Edition

Authors: Anne Marie Ward, Andrew Thomas