Two copy machines are available. Both have useful lives of 5 years. One machine can be either

Question:

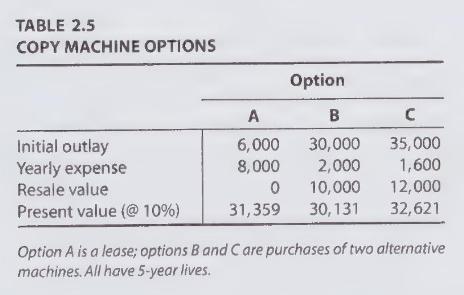

Two copy machines are available. Both have useful lives of 5 years. One machine can be either leased or purchased outright; the other must be purchased. Hence there are a total of three options: A, B, and C. The details are shown in Table 2.5. (The first year's maintenance is included in the initial cost. There are then four additional maintenance payments, occurring at the beginning of each year, followed by revenues from resale.) The present values of the expenses of these three options using a \(10 \%\) interest rate are also indicated in the table. According to a present value analysis, the machine of least cost, as measured by the present value, should be selected; that is, option B.

It is not possible to compute the IRR for any of these alternatives, because all cash flows are negative (except for the resale values). However, it is possible to calculate the IRR on an incremental basis. Find the IRR corresponding to a change from A to B. Is a change from \(A\) to \(B\) justified on the basis of the IRR?

Step by Step Answer: