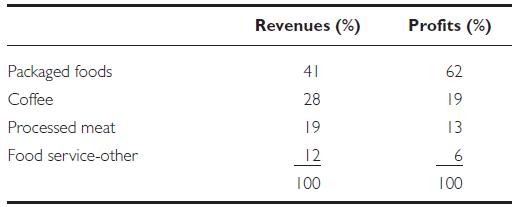

PGJ is a large producer of food products. In 2015, the percentage breakdown of revenues and profits

Question:

PGJ is a large producer of food products. In 2015, the percentage breakdown of revenues and profits was as follows:

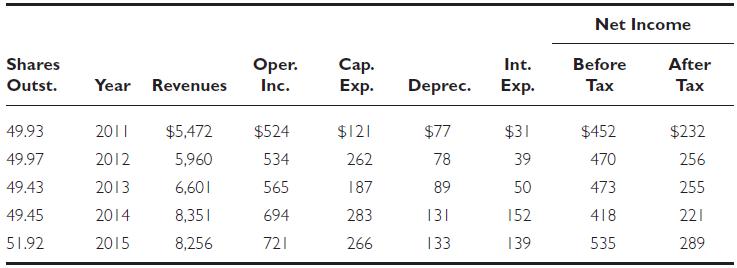

International operations account for about 22 percent of sales and 17 percent of operating profit. For the 2011–2015 fiscal years, the number of shares outstanding (in millions) and selected income statement data were (in millions of dollars) as follows:

a. For each year, calculate operating income as a percentage of revenues.

b. Calculate annual net profits after tax as a percentage of revenues.

c. Calculate annual after-tax profits per share outstanding (EPS).

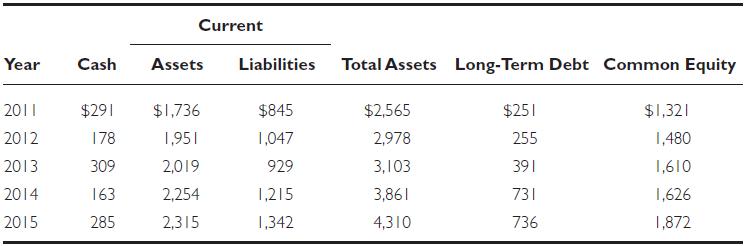

The balance sheet data for the same fiscal years (in millions of dollars) were as follows:

d. Calculate the ratio of current assets to current liabilities for each year.

e. Calculate long‐term debt as a percentage of common equity for each year.

f. For each year, calculate the book value per share as the common equity divided by the number of shares outstanding.

g. Calculate ROE for each year.

h. Calculate ROA for each year.

i. Calculate leverage for each year.

j. Calculate the net income margin for each year.

k. Calculate turnover for each year.

l. Calculate the EBIT for each year.

m. Calculate the income ratio for each year.

n. Calculate operating efficiency for each year.

o. On the basis of these calculations, evaluate the current status of the health of PGJ and the changes over the period.

Step by Step Answer:

Investments Analysis And Management

ISBN: 9781118975589

13th Edition

Authors: Charles P. Jones, Gerald R. Jensen