Consider the following numerical example of the IS-LM model: a. Derive the IS relation. (You want an

Question:

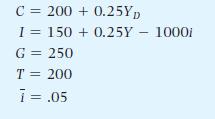

Consider the following numerical example of the IS-LM model:

a. Derive the IS relation. (You want an equation with Y on the left side and everything else on the right.)

b. The central bank sets an interest rate of 5%. How is that decision represented in the equations?

c. What is the level of real money supply when the interest rate is 5%? Use the expression:

![]()

d. Solve for the equilibrium values of C and I, and verify the value you obtained for Y by adding C, I, and G.

e. Now suppose that the central bank cuts the interest rate to 3%. How does this change the LM curve? Solve for Y, I, and C, and describe in words the effects of an expansionary monetary policy. What is the new equilibrium value of M/P supply?

f. Return to the initial situation in which the interest rate set by the central bank is 5%. Now suppose that government spending increases to G = 400. Summarize the effects of an expansionary fiscal policy on Y, I, and C. What is the effect of the expansionary fiscal policy on the real money supply?

g. Starting from an interest rate equal to 5% and government spending equal to 250 units, increase government spending to 400 units while fixing the real money supply at 1600 units. [The money market must be in equilibrium so 1600 = 2Y - 8000i (part c) and the goods market must be in equilibrium so Y = C + I + G at the same values of Y and i.] Compare the effect of the increase in government spending on Y, I and C to the same increase in G in part g and explain the difference.

Step by Step Answer: