Consider a self-financing trading strategy of a portfolio with a dividend paying asset and a money market

Question:

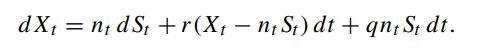

Consider a self-financing trading strategy of a portfolio with a dividend paying asset and a money market account over the time horizon [0,T ]. Under the risk neutral measure Q, let the dynamics of the asset price St be governed by

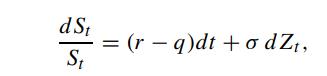

where q is the dividend yield, q = r. We adopt the trading strategy of holding nt units of the asset at time t, where

![nt -q(T-1) e-r(T-1)]. F[e-907 - 1 (r = q) T](https://dsd5zvtm8ll6.cloudfront.net/images/question_images/1700/5/4/3/054655c3a4eeea641700543053094.jpg)

Let Xt denote the portfolio value at time t, whose dynamics is then given by

The initial portfolio value X0 is chosen to be

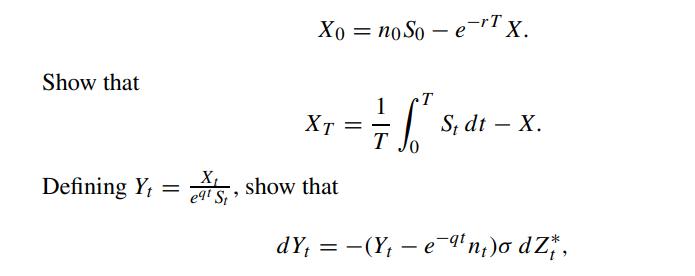

where Z∗t = Zt − σt is a Brownian process under Q∗-measure with eqtSt as the numeraire. Note that the price function of the fixed strike Asian call option with strike X is given by

![C fix (So, 0; X) = e-T Eg[max(X7, 0)] = Soer Eq*[max(Y, 0)], with Show that Yo = - Xo So (r-q)T e-qTe-rT = t](https://dsd5zvtm8ll6.cloudfront.net/images/question_images/1700/5/4/3/347655c3b7329d341700543345282.jpg)

with u(y,T ) = max(y, 0).

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: