EVA Company was incorporated on January 2, Year 5, and commenced active operations immediately. Ordinary shares were

Question:

EVA Company was incorporated on January 2, Year 5, and commenced active operations immediately. Ordinary shares were issued on the date of incorporation and no new ordinary shares have been issued since then. On December 31, Year 9, PAL Company purchased 70% of the outstanding ordinary shares of the EVA for 1.5 million euros (€).

EVA's main operations are located in Germany. It manufactures and sells German equipment throughout Europe. PAL acquired control over EVA so that it could utilize EVA's extensive distribution network. EVA continued to manufacture and sell German equipment. However, it also purchases and sells equipment manufactured by PAL in Canada. EVA has 90 days to pay for its purchases from PAL. During this time, EVA is usually able to resell the equipment in Europe and collect the receivables.

EVA did not have to hire additional sales people to sell the product. It built a new distribution centre in Frankfurt. This facility was financed with retained earnings from EVA Company.

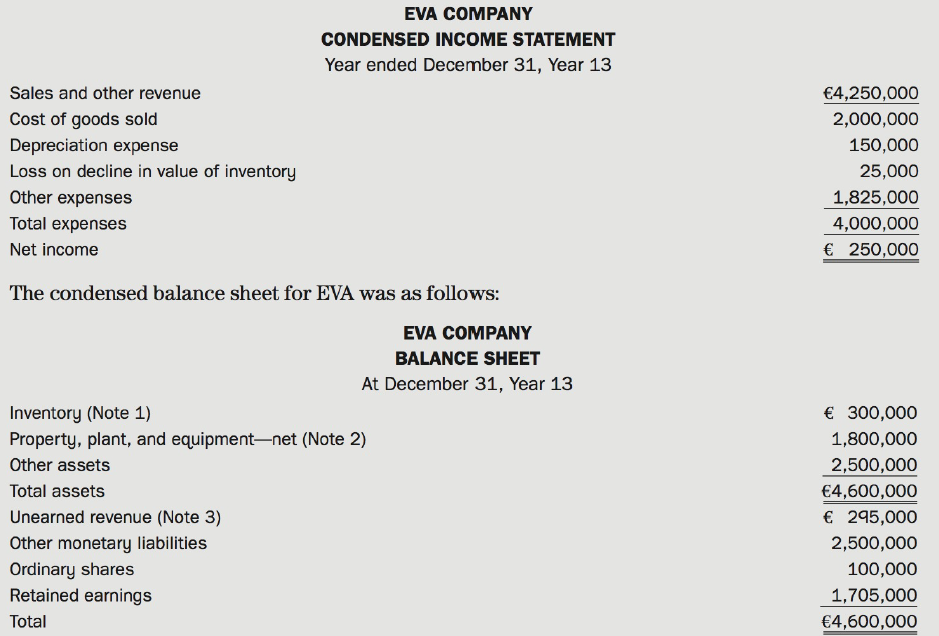

For the year ending December 31, Year 13, the condensed income statement for EVA was as follows:

Additional Information:

1. At December 31, Year 12, inventory was €280,000. The inventory at the end of Year 12 and Year 13 was purchased evenly throughout the last month of each year. The inventory at December 31, Year 13, had cost EVA €325,000 but had been written down to its net realizable value of €300,000. Purchases and sales of inventory occurred evenly throughout the year.

2. EVA purchased its property, plant and equipment on March 17, Year 9. There were no purchases or sales of property, plant, and equipment since March 17, Year 9.

3. The unearned revenue represents non-refundable deposits received from customers evenly throughout the last quarter of the year.

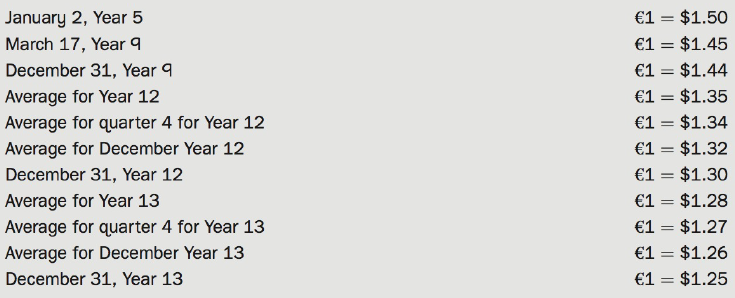

4. Foreign exchange rates were as follows:

Required:

(a) Provide two facts from EVA's situation that would indicate that EVA's functional currency is the Canadian dollar and two facts from EVA's situation that would indicate that EVA's functional currency is the euro.

(b) Assuming that EVA's functional currency is the Canadian dollar, calculate the Canadian dollar amount for the following items on EVA's translated financial statements:

(i) Cost of goods sold for the year ended December 31, Year 13

(ii) Depreciation expense for the year ended December 31, Year 13

(iii) Inventory at end of year Year 13

(iv) Unearned revenue at end of year Year 13

(v) Ordinary shares at end of year Year 13

(c) Assume that foreign exchange gains (losses) for Year 13 would be $125,000 of gains under the FCT method and $85,000 in losses under the PCT method. Explain the main reason that would cause the difference in the foreign exchange gains/losses between the two methods. Explain how one method could report a gain, whereas the other method would report a loss for the same situation.

DistributionThe word "distribution" has several meanings in the financial world, most of them pertaining to the payment of assets from a fund, account, or individual security to an investor or beneficiary. Retirement account distributions are among the most...

Step by Step Answer:

Modern Advanced Accounting in Canada

ISBN: 978-1259087554

8th edition

Authors: Hilton Murray, Herauf Darrell