On December 31, Year 2, Palm Inc. purchased 80% of the outstanding ordinary shares of Storm Company

Question:

On December 31, Year 2, Palm Inc. purchased 80% of the outstanding ordinary shares of Storm Company for $350,000. At that date, Storm had ordinary shares of $240,000 and retained earnings of $64,000. In negotiating the purchase price, it was agreed that the assets on Storm's statement of financial position were fairly valued except for plant assets, which had a $44,000 excess of fair value over carrying amount. It was also agreed that Storm had unrecognized intangible assets consisting of trademarks that had an estimated value of $36,000. The plant assets had a remaining useful life of eight years at the acquisition date and the trademarks would be amortized over a 12-year period. Any goodwill arising from this business combination would be tested periodically for impairment. Palm accounts for its investment using the cost method.

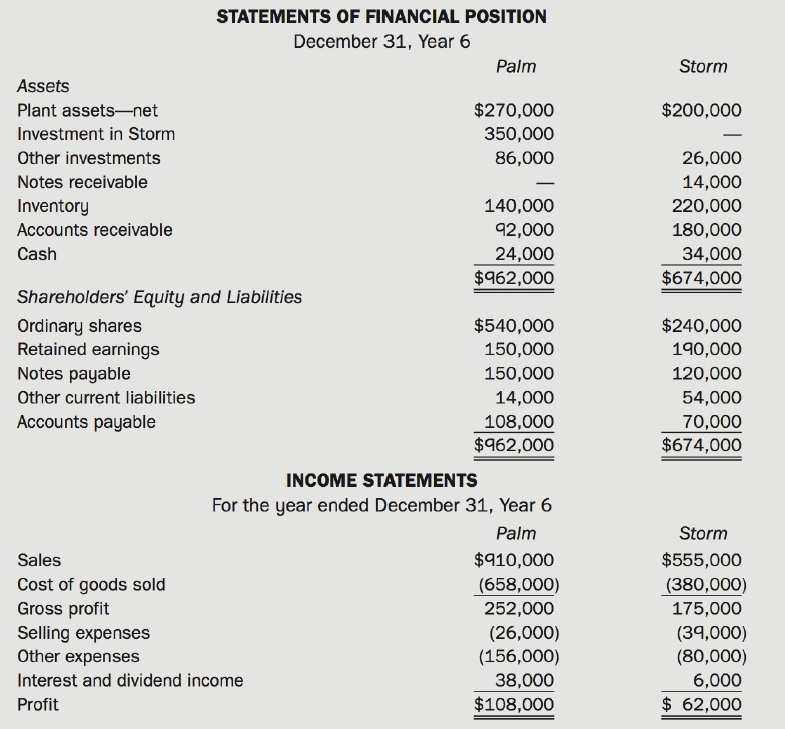

Financial statements for Palm and Storm for the year ended December 31, Year 6, were as follows:

Additional Information

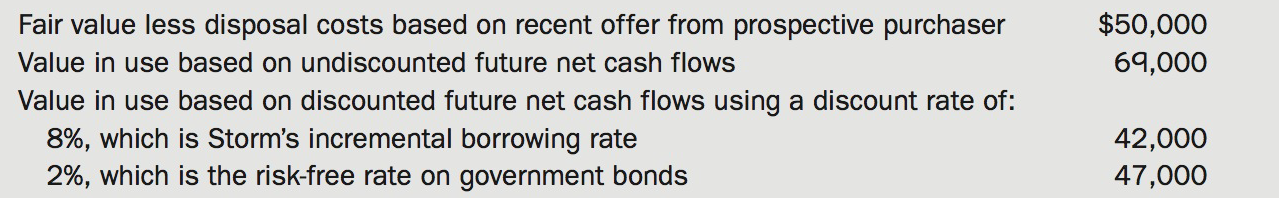

• At December 31, Year 6, an impairment test of Storm's goodwill revealed the following:

• An impairment test indicated that the trademarks had a recoverable amount of $14,350. The impairment loss on these assets occurred entirely in Year 6.

• On December 26, Year 6, Palm declared dividends of $40,000, while Storm declared dividends of $24,000.

• Amortization expense is reported in selling expenses, while impairment losses are reported in other expenses.

(a) Prepare consolidated financial statements.

(b) If none of the acquisition differential had been allocated to trademarks at the date of acquisition, how would this affect

(i) The return on total shareholders' equity for Year 6?

(ii) the debt-to-equity ratio at the end of Year 6?

Goodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of... Intangible Assets

An intangible asset is a resource controlled by an entity without physical substance. Unlike other assets, an intangible asset has no physical existence and you cannot touch it.Types of Intangible Assets and ExamplesSome examples are patented...

Step by Step Answer:

Modern Advanced Accounting in Canada

ISBN: 978-1259087554

8th edition

Authors: Hilton Murray, Herauf Darrell