Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Which one of the following statements is correct concerning the short-term financial policy of a firm? A. A flexible short-term policy maintains a relatively

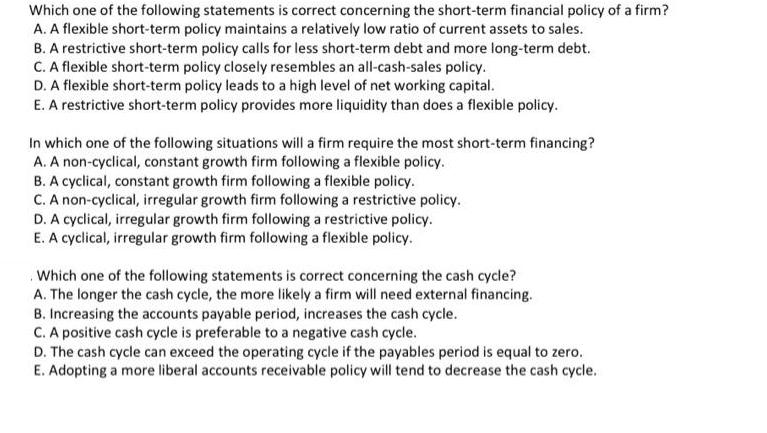

Which one of the following statements is correct concerning the short-term financial policy of a firm? A. A flexible short-term policy maintains a relatively low ratio of current assets to sales. B. A restrictive short-term policy calls for less short-term debt and more long-term debt. C. A flexible short-term policy closely resembles an all-cash-sales policy. D. A flexible short-term policy leads to a high level of net working capital. E. A restrictive short-term policy provides more liquidity than does a flexible policy. In which one of the following situations will a firm require the most short-term financing? A. A non-cyclical, constant growth firm following a flexible policy. B. A cyclical, constant growth firm following a flexible policy. C. A non-cyclical, irregular growth firm following a restrictive policy. D. A cyclical, irregular growth firm following a restrictive policy. E. A cyclical, irregular growth firm following a flexible policy. Which one of the following statements is correct concerning the cash cycle? A. The longer the cash cycle, the more likely a firm will need external financing. B. Increasing the accounts payable period, increases the cash cycle. C. A positive cash cycle is preferable to a negative cash cycle. D. The cash cycle can exceed the operating cycle if the payables period is equal to zero. E. Adopting a more liberal accounts receivable policy will tend to decrease the cash cycle.

Step by Step Solution

★★★★★

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

1 D is the correct option Explanation Shortterm financing is generally used for less than a year A shortterm policy is used for supporting the working ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started