A fund's risk appetite is such that it wants to be 97.5% certain it will not lose

Question:

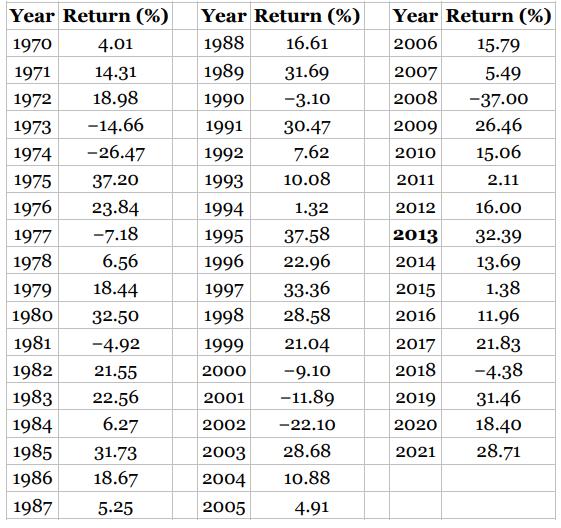

A fund's risk appetite is such that it wants to be 97.5% certain it will not lose more than 25% in any one year. Using the performance of the S&P 500 between 1970 and 2021 (see Table 24.1), determine the beta the fund should have. Assume a risk‐ free rate of 2.5% per annum.

Table 24.1

Transcribed Image Text:

Year Return (%) 1970 4.01 1971 14.31 1972 18.98 1973 -14.66 1974 -26.47 1975 1976 37.20 23.84 1977 -7.18 1978 6.56 1979 18.44 1980 32.50 1981 -4.92 1982 21.55 1983 22.56 1984 6.27 1985 31.73 1986 18.67 1987 5.25 Year Return (%) 1988 16.61 1989 31.69 1990 -3.10 1991 30.47 1992 7.62 1993 10.08 1994 1.32 1995 37.58 1996 22.96 1997 33-36 1998 28.58 1999 21.04 2000 -9.10 2001 -11.89 2002 -22.10 2003 28.68 2004 10.88 2005 4.91 Year Return (%) 2006 15.79 2007 5.49 2008 -37.00 26.46 15.06 2.11 16.00 32.39 13.69 1.38 11.96 21.83 -4.38 31.46 18.40 28.71 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

Answered By

Krishnavendra Y

I am a self motivated financial professional knowledgeable in; preparation of financial reports, reconciling and managing accounts, maintaining cash flows, budgets, among other financial reports. I possess strong analytical skills with high attention to detail and accuracy. I am able to act quickly and effectively when dealing with challenging situations. I have the ability to form positive relationships with colleagues and I believe that team work is great key to performance. I always deliver quality, detailed, original (0% plagiarism), well-researched and critically analyzed papers.

5.00+

4+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

A fund's risk appetite is such that it wants to be 97.5% certain it will not lose more than 25% in any one year. Using the performance of the S&P 500 between 1994 and 2003 (see Table 27.2) determine...

-

A fund's risk appetite is such that it wants to be 90% certain that it will not lose more than 20% in any one year. Using the performance of the S&P 500 between 1970 and 2021 (see Table 24.1),...

-

A fund's risk appetite is such that it wants to be 97.5% certain it will not lose more than 25% in any one year. Using the performance of the S&P 500 between 1997 and 2016 (see Table 27.2), determine...

-

1 of 4 Set 1 UIBS United International Business Schools Class Work Mergers and Acquisitions 1. Rudy's, Inc. and Blackstone, Inc. are all-equity firms. Rudy's has 1,500 shares outstanding at al market...

-

Are variable-rate bonds attractive to investors who expect interest rates to decrease? Explain. Would a firm that needs to borrow funds consider issuing variable-rate bonds if it expects that...

-

Hong Kong currency board and the Chinese yuan. For the past 25 years Hong Kong has relied on a currency board to peg its currency against the U.S. dollar at HK$7.80 = US$1. Since 2005, the Chinese...

-

Refer to the information in Exercise 17-1. Assume that the following information is available for the companys two products for the first quarter of 2017. Required Compute activity rates for each...

-

Tom Schriber, a director of personnel of Management Resources, Inc., is in the process of designing a program that its customers can use in the job-finding process. Some of the activities include...

-

Why, in fact, does Marxism breed regimes which are totalitarian in nature? How does multiculturalism at play?

-

When a steel company goes bankrupt, other companies in the same industry benefit because they have one less competitor. But when a bank goes bankrupt other banks do not necessarily benefit. Explain...

-

Calculate the interest rate paid by MdP six years after the beginning of the deal in Business Snapshot 24.2 if the Euribor rate proves to be 8% from year 2 onward. BUSINESS SNAPSHOT 24.2 The...

-

On January 1, 2012, the Von Schoppe Company purchased a delivery truck for $20,000. The truck had an estimated useful life of six years and a salvage value of $2,000. On September 30, 2014, Von...

-

As the manager of this hotel, it is my responsibility to ensure that all staff members are properly trained in customer service and complaint resolution. What happens when upper management does not...

-

Suppose Imperial Black has come up with the following positioning statement: 'Scent of Bandung, Flavour of Jakarta, your Imperials now in Europe'. Which strategy is Imperial Black using through this...

-

Now to the other end of the Supply Chain, give some examples in your workplace where you interface with customers and where customers are involved to make your company better. If you do not directly...

-

Empowerment as a strategy to mitigate the perception of threat relative to innovation adoption refers to the idea of giving individuals or teams more authority and responsibility to foster a sense of...

-

Provide a short summary of the career path Discuss: What did you find of interest in the session? How does the career path fit with your own career interests?

-

Partial Frisch and Waugh in the least squares regression of y on a constant and X, to compute the regression coefficients on X, we can first transform y to deviations from the mean y and, likewise,...

-

This problem continues the Draper Consulting, Inc., situation from Problem 12-45 of Chapter 12. In October, Draper has the following transactions related to its common shares: Oct 1 Draper...

-

Joe Tulkin owns Tulkin Wholesale Co. He sells paper, tape, file folders, and other office supplies to about 120 retailers in nearby cities. His average retailer-customer spends about $900 a month....

-

Why do many department stores seek a markup of about 30 percent when some discount houses operate on a 20 percent markup?

-

A producer distributed its riding lawn mowers through wholesalers and retailers. The retail selling price was $800, and the manufacturing cost to the company was $312. The retail markup was 35...

-

Explain the importance of ethical expectations and modeling ethical practices in le within education. your future

-

What is the difference between academic and business communication? Explain in detail

-

Discuss the culinary terms and trade names for ingredients used in standard recipes for vegetable, fruit, egg and farinaceous dishes. Choose at least 4 ingredients and explain each one. 2. What is...

Study smarter with the SolutionInn App