Gabriela and Harry own the GH Partnership, which has conducted business for 10 years. The bases for

Question:

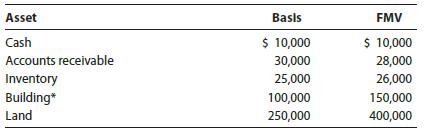

Gabriela and Harry own the GH Partnership, which has conducted business for 10 years. The bases for their partnership interests are $100,000 for Gabriela and $150,000 for Harry. GH Partnership holds the following assets.

Gabriela and Harry sell their partnership interests to Keith and Liang for $307,000 each.

a. Determine the tax consequences of the sale to Gabriela, Harry, and GH.

b. From a tax perspective, would it matter to Keith and Liang whether they purchase Gabriela’s and Harry’s partnership interests or the partnership assets from GH Partnership?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

South-Western Federal Taxation 2022 Corporations, Partnerships, Estates And Trusts

ISBN: 9780357519240

45th Edition

Authors: William A. Raabe, James C. Young, Annette Nellen, William H. Hoffman

Question Posted: