Gull Corporation, a cash method, calendar year C corporation, was formed and began business on November 1,

Question:

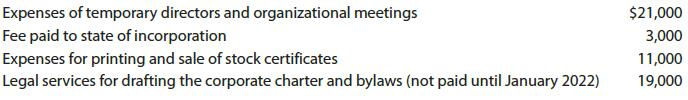

Gull Corporation, a cash method, calendar year C corporation, was formed and began business on November 1, 2021. Gull incurred the following expenses during its first year of operations (November 1, 2021–December 31, 2021):

a. Assuming that Gull Corporation elects under § 248 to expense and amortize organizational expenditures, what amount may be deducted in 2021?

b. Assume the same facts as above, except that the amount paid for the legal services was $28,000 (instead of $19,000). What amount may be deducted as organizational expenditures in 2021?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

South-Western Federal Taxation 2022 Corporations, Partnerships, Estates And Trusts

ISBN: 9780357519240

45th Edition

Authors: William A. Raabe, James C. Young, Annette Nellen, William H. Hoffman

Question Posted: