A Ltd owns 85% of B Ltd and 60% of C Ltd. B Ltd owns 90% of

Question:

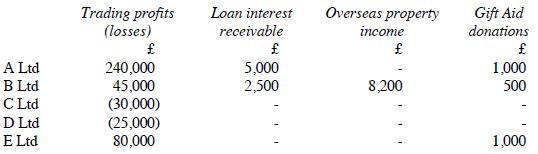

A Ltd owns 85% of B Ltd and 60% of C Ltd. B Ltd owns 90% of D Ltd. The remaining 40% of C Ltd is owned by E Ltd. All these percentages represent holdings of ordinary shares and all companies are UK resident. Results for the year to 31 March 2021 are as follows:

The overseas property income of B Ltd is the net figure after deduction of 18% foreign tax. A Ltd received a dividend of £17,000 from B Ltd on 31 December 2020.

Required:

Calculate the corporation tax payable for the year by all of these companies, assuming that maximum group relief is claimed for the trading losses and that double tax relief is given where appropriate.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: