Wayne Corporation is subject to State As franchise tax. The tax is imposed at a rate of

Question:

Wayne Corporation is subject to State A’s franchise tax. The tax is imposed at a rate of 1.2% of the corporation’s net worth that is apportioned to the state by use of a two-factor formula (sales and property factors, equally weighted). The property factor includes real and tangible personal property, valued at historical cost as of the end of the taxable year.

Forty percent of Wayne’s sales are attributable to A, and $600,000 of the cost of Wayne’s tangible personal property is located in A.

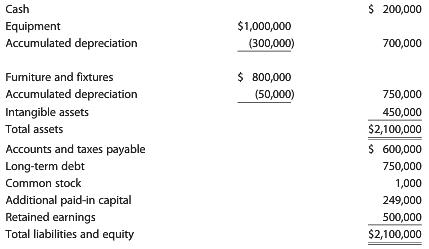

Determine the A franchise tax payable by Wayne this year, given the following end-of-the-year balance sheet.

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

South Western Federal Taxation 2018 Corporations Partnerships Estates And Trusts

ISBN: 1389

41st Edition

Authors: William H. Hoffman, William A. Raabe, James C. Young, Annette Nellen, David M. Maloney

Question Posted: