Joint costs and byproducts. (W. Crum adapted) Royston, Inc., is a large food processing company.It processes 150,000

Question:

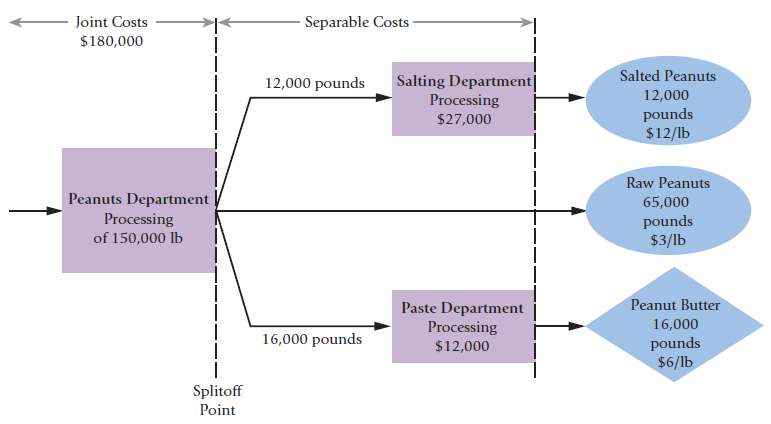

Joint costs and byproducts. (W. Crum adapted) Royston, Inc., is a large food processing company.It processes 150,000 pounds of peanuts in the peanuts department at a cost of $180,000 to yield12,000 pounds of product A, 65,000 pounds of product B, and 16,000 pounds of product C.Product A is processed further in the salting department to yield 12,000 pounds of salted peanuts at a cost of $27,000 and sold for $12 per pound.Product B (raw peanuts) is sold without further processing at $3 per pound.Product C is considered a byproduct and is processed further in the paste department to yield 16,000 pounds of peanut butter at a cost of $12,000 and sold for $6 per pound.The company wants to make a gross margin of 10% of revenues on product C and needs to allow 20% of revenues for marketing costs on product C. An overview of operations follows:

Required1. Compute unit costs per pound for products A, B, and C, treating C as a byproduct. Use the NRV method for allocating joint costs. Deduct the NRV of the byproduct produced from the joint cost of products A and B.2. Compute unit costs per pound for products A, B, and C, treating all three as joint products and allocating joint costs by the NRVmethod.

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 978-0132109178

14th Edition

Authors: Charles T. Horngren, Srikant M.Dater, George Foster, Madhav