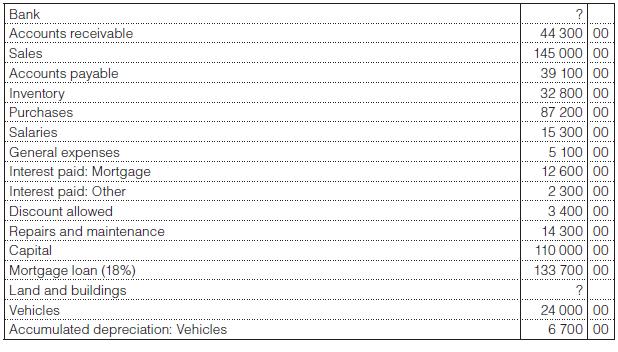

These balances and totals appeared in the books of Peters Parlour as at 28 February 20x6: Additional

Question:

These balances and totals appeared in the books of Peters Parlour as at 28 February 20x6:

Additional information:

1. The bookkeeper had made these errors:

– Omitted a debit of R500 in determining the balance for general expenses.

– Overstated payables by R4 500 due to incorrect casting.

– Posted the payment of R1 700 for December salaries as a credit to Bank and a credit to salaries.

– Recorded cash sales of R500 as a debit to cash and a debit to the repairs and maintenance account.

– Posted interest paid on the mortgage loan of R6 300 as a debit to the capital portion of the mortgage loan and a credit to Bank.

2. Land and buildings were acquired on 1 July 20x3 and were financed by a 25% cash payment and a mortgage bond for the balance.

– The mortgage bond is repayable annually in arrears on 28 February over 12 years.

– The final partial payment is due on 30 June 20x6.

– The instalment due on 1 March 20x6 has been included with accounts payable in the trial balance.

– Interest at 18% per annum is repayable quarterly in arrears on 1 March, 1 June, 1 September and 1 December.

– No further land and buildings were acquired. Land and buildings are not depreciated.

3. Repairs and maintenance include these expenses:

– Erection of new wall R8 000

– Painting of building R3 200

4. Depreciation on vehicles is calculated at 10% per annum on the diminishing-balance method. A vehicle that cost R9 600 was acquired on 30 November 20x5 and no vehicles were sold during the year.

5. Goods received amounting to R8 900 have not been raised. The merchandise was included in the inventory count on 28 February 20x6 that resulted in a physical closing inventory value of R23 700.

6. Two receivables have been liquidated:

– XYZ Enterprises R6 300

– Dicey Company R3 400

A liquidation dividend of 15c in the R1, from Dicey Company, was received and banked on 28 February 20x6.

Further receivables of R4 600 are considered doubtful.

You are required to:

1. As far as the information provided allows, prepare the general journal entries for adjustments 1 to 6 above.

2. Calculate the cost of land and buildings.

3. Prepare a post-adjustment trial balance at 28 February 20x6 (before adjusting for closing inventory).

4. Prepare the trading account for Peters Parlours.

5. Prepare the profit and loss account for Peters Parlours.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit