Answered step by step

Verified Expert Solution

Question

1 Approved Answer

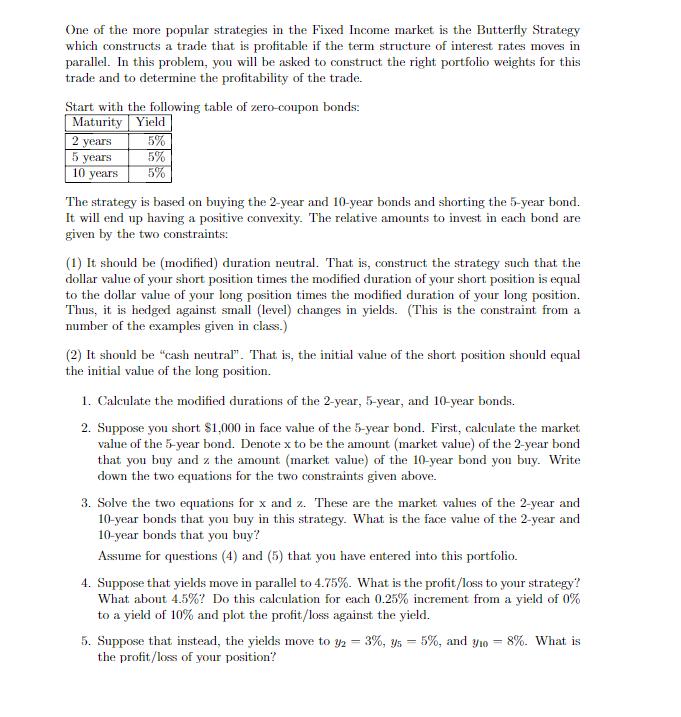

One of the more popular strategies in the Fixed Income market is the Butterfly Strategy which constructs a trade that is profitable if the

One of the more popular strategies in the Fixed Income market is the Butterfly Strategy which constructs a trade that is profitable if the term structure of interest rates moves in parallel. In this problem, you will be asked to construct the right portfolio weights for this trade and to determine the profitability of the trade. Start with the following table of zero-coupon bonds: Maturity Yield 2 years 5 years 10 years 5% 5% The strategy is based on buying the 2-year and 10-year bonds and shorting the 5-year bond. It will end up having a positive convexity. The relative amounts to invest in each bond are given by the two constraints: (1) It should be (modified) duration neutral. That is, construct the strategy such that the dollar value of your short position times the modified duration of your short position is equal to the dollar value of your long position times the modified duration of your long position. Thus, it is hedged against small (level) changes in yields. (This is the constraint from a number of the examples given in class.) (2) It should be "cash neutral". That is, the initial value of the short position should equal the initial value of the long position. 1. Calculate the modified durations of the 2-year, 5-year, and 10-year bonds. 2. Suppose you short $1,000 in face value of the 5-year bond. First, calculate the market value of the 5-year bond. Denote x to be the amount (market value) of the 2-year bond that you buy and z the amount (market value) of the 10-year bond you buy. Write down the two equations for the two constraints given above. 3. Solve the two equations for x and z. These are the market values of the 2-year and 10-year bonds that you buy in this strategy. What is the face value of the 2-year and 10-year bonds that you buy? Assume for questions (4) and (5) that you have entered into this portfolio. 4. Suppose that yields move in parallel to 4.75%. What is the profit/loss to your strategy? What about 4.5%? Do this calculation for each 0.25% increment from a yield of 0% to a yield of 10% and plot the profit/loss against the yield. 5. Suppose that instead, the yields move to y2 = 3%, ys - 5%, and yio - 8%. What is the profit/loss of your position?

Step by Step Solution

★★★★★

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculate the modified durations of the 2year 5year and 10year bonds The modified duration is calculated using the formula Modified Duration 1 1 YTM100 1 YTM100n 1 YTM where YTM is the yield to matu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started