Question: Consider again the investors decision problem described in Problem 5. Use the PrecisionTree add-in to identify the strategy that maximizes the investors expected earnings in

Consider again the investor’s decision problem described in Problem 5. Use the PrecisionTree add-in to identify the strategy that maximizes the investor’s expected earnings in one year from the given investment opportunities. Also, perform sensitivity analysis on the optimal decision and summarize your findings. In response to which model inputs is the expected earnings value most sensitive?

Problem 5

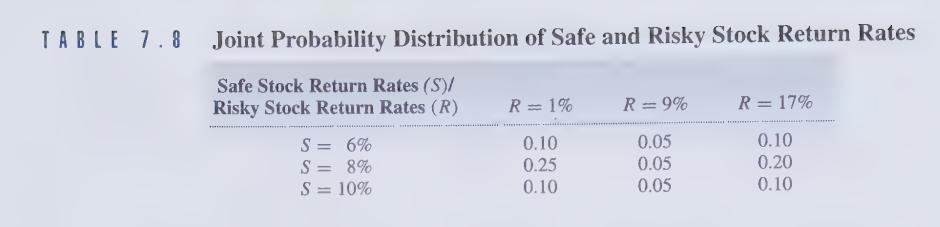

Consider an investor with $10,000 available to invest. He has the following options regarding the allocation of his available funds: (1) he can invest in a risk-free savings account with a guaranteed 3% annual rate of return; (2) he can invest in a fairly safe stock, where the possible annual rates of return are 6%, 8%, or 10%; or (3) he can invest in a more risky stock where the possible annual rates of return are 1%, 9%, or 17%. Note that the investor can place all of his available funds in any one of these options, or he can split his $10,000 into two $5000 investments in any two of these options. The joint probability distribution of the possible return rates for the two aforementioned stocks is given in Table 7.8 (page 310).

TABLE 7.8 Joint Probability Distribution of Safe and Risky Stock Return Rates Safe Stock Return Rates (S)/ Risky Stock Return Rates (R) S = 6% S = 8% S = 10% R = 1% 0.10 0.25 0.10 R = 9% 0.05 0.05 0.05 R = 17% 0.10 0.20 0.10

Step by Step Solution

3.43 Rating (172 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts