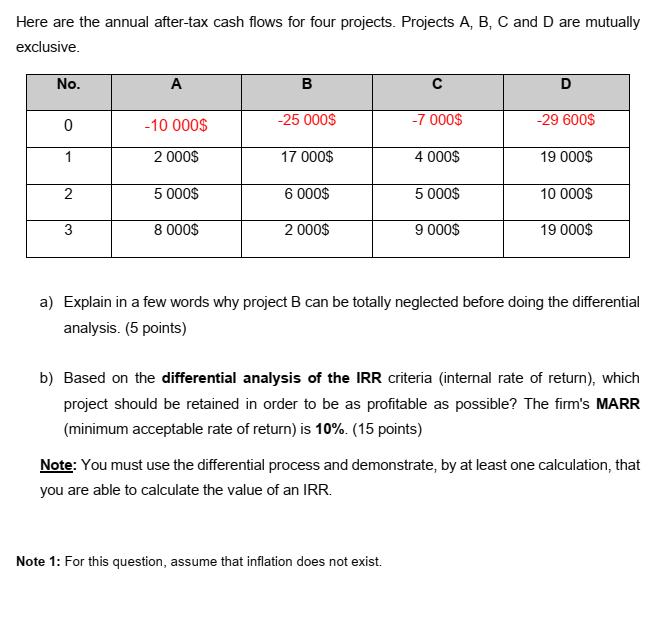

Question: Here are the annual after-tax cash flows for four projects. Projects A, B, C and D are mutually exclusive. No. 0 1 2 3

Here are the annual after-tax cash flows for four projects. Projects A, B, C and D are mutually exclusive. No. 0 1 2 3 A -10 000$ 2 000$ 5 000$ 8 000$ B -25 000$ 17 000$ 6 000$ 2 000$ -7 000$ 4 000$ 5 000$ 9 000$ D Note 1: For this question, assume that inflation does not exist. -29 600$ 19 000$ 10 000$ 19 000$ a) Explain in a few words why project B can be totally neglected before doing the differential analysis. (5 points) b) Based on the differential analysis of the IRR criteria (internal rate of return), which project should be retained in order to be as profitable as possible? The firm's MARR (minimum acceptable rate of return) is 10%. (15 points) Note: You must use the differential process and demonstrate, by at least one calculation, that you are able to calculate the value of an IRR.

Step by Step Solution

3.56 Rating (170 Votes )

There are 3 Steps involved in it

a Project B can be totally neglected before doing the differential analysis because its initial inve... View full answer

Get step-by-step solutions from verified subject matter experts