Question: 3. ;) Decision Making Under Risk & Uncertainty. You are the technical assistant to the CEO of Airbus. Airbus wants to design and build

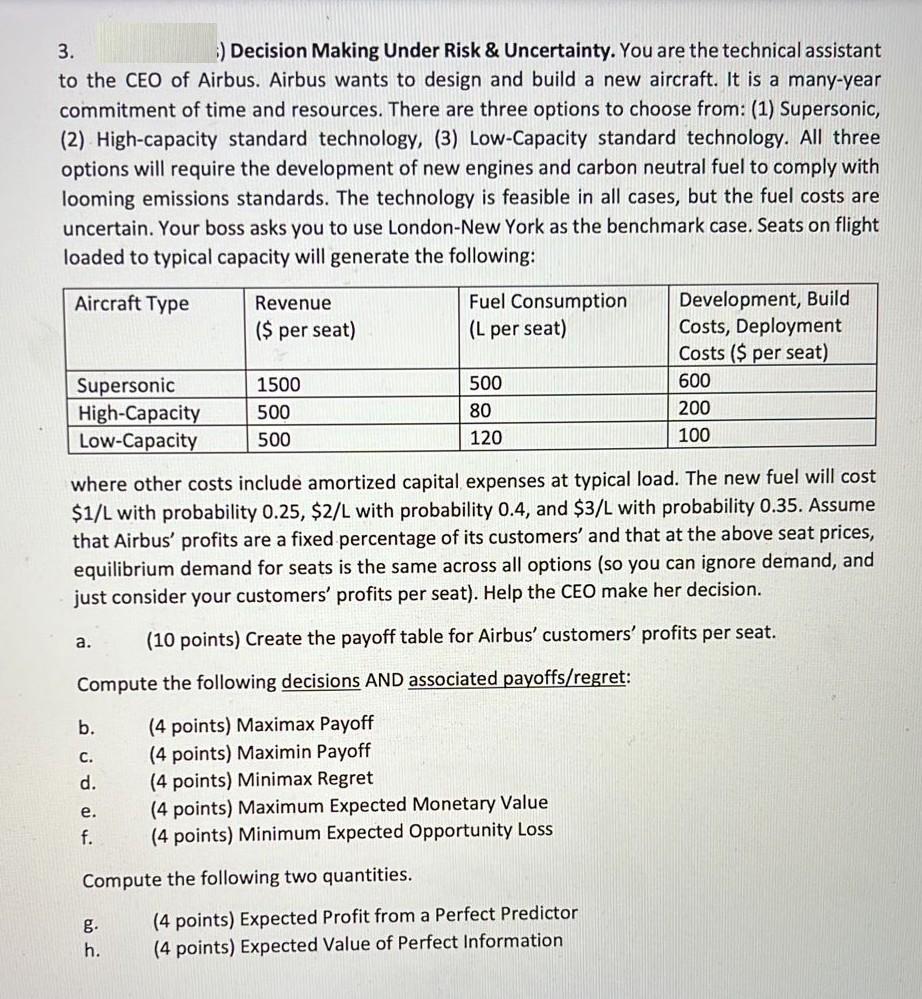

3. ;) Decision Making Under Risk & Uncertainty. You are the technical assistant to the CEO of Airbus. Airbus wants to design and build a new aircraft. It is a many-year commitment of time and resources. There are three options to choose from: (1) Supersonic, (2) High-capacity standard technology, (3) Low-Capacity standard technology. All three options will require the development of new engines and carbon neutral fuel to comply with looming emissions standards. The technology is feasible in all cases, but the fuel costs are uncertain. Your boss asks you to use London-New York as the benchmark case. Seats on flight loaded to typical capacity will generate the following: Aircraft Type Supersonic High-Capacity Low-Capacity a. b. C. d. where other costs include amortized capital expenses at typical load. The new fuel will cost $1/L with probability 0.25, $2/L with probability 0.4, and $3/L with probability 0.35. Assume that Airbus' profits are a fixed percentage of its customers' and that at the above seat prices, equilibrium demand for seats is the same across all options (so you can ignore demand, and just consider your customers' profits per seat). Help the CEO make her decision. (10 points) Create the payoff table for Airbus' customers' profits per seat. e. f. Revenue ($ per seat) Compute the following decisions AND associated payoffs/regret: 1500 500 500 g. h. Fuel Consumption (L per seat) (4 points) Maximax Payoff (4 points) Maximin Payoff (4 points) Minimax Regret Compute the following two quantities. 500 80 120 (4 points) Maximum Expected Monetary Value (4 points) Minimum Expected Opportunity Loss Development, Build Costs, Deployment Costs ($ per seat) 600 200 100 (4 points) Expected Profit from a Perfect Predictor (4 points) Expected Value of Perfect Information

Step by Step Solution

3.39 Rating (161 Votes )

There are 3 Steps involved in it

a Payoff T... View full answer

Get step-by-step solutions from verified subject matter experts