Question: Alan makes macrame animals in his spare time. He sold $9,000 worth of macrame animals during the year and incurred the following related expenses.

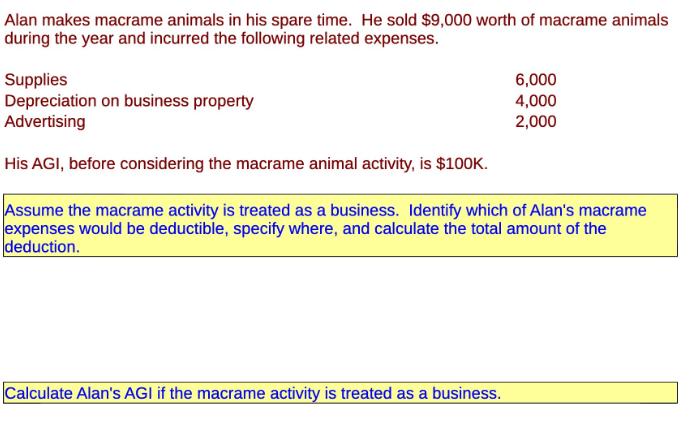

Alan makes macrame animals in his spare time. He sold $9,000 worth of macrame animals during the year and incurred the following related expenses. Supplies Depreciation on business property Advertising His AGI, before considering the macrame animal activity, is $100K. 6,000 4,000 2,000 Assume the macrame activity is treated as a business. Identify which of Alan's macrame expenses would be deductible, specify where, and calculate the total amount of the deduction. Calculate Alan's AGI if the macrame activity is treated as a business.

Step by Step Solution

There are 3 Steps involved in it

Deductible Expenses and AGI Calculation for Alans Macrame Activity Deductible... View full answer

Get step-by-step solutions from verified subject matter experts